It was bound to happen. After the feel-good story that was the 2021 statistical year for carpet—when a COVID-19-led rally helped catapult residential sales to double-digit percentage gains—the pendulum swung the other way in 2022.

It was bound to happen. After the feel-good story that was the 2021 statistical year for carpet—when a COVID-19-led rally helped catapult residential sales to double-digit percentage gains—the pendulum swung the other way in 2022.

The gravitational pull of more normal business conditions returning—coupled with 30-year-high inflation and rising interest and mortgage rates—brought carpet back to earth. The ray of sunshine for the soft surface category was the commercial segment, which saw an increase in dollars while units fell.

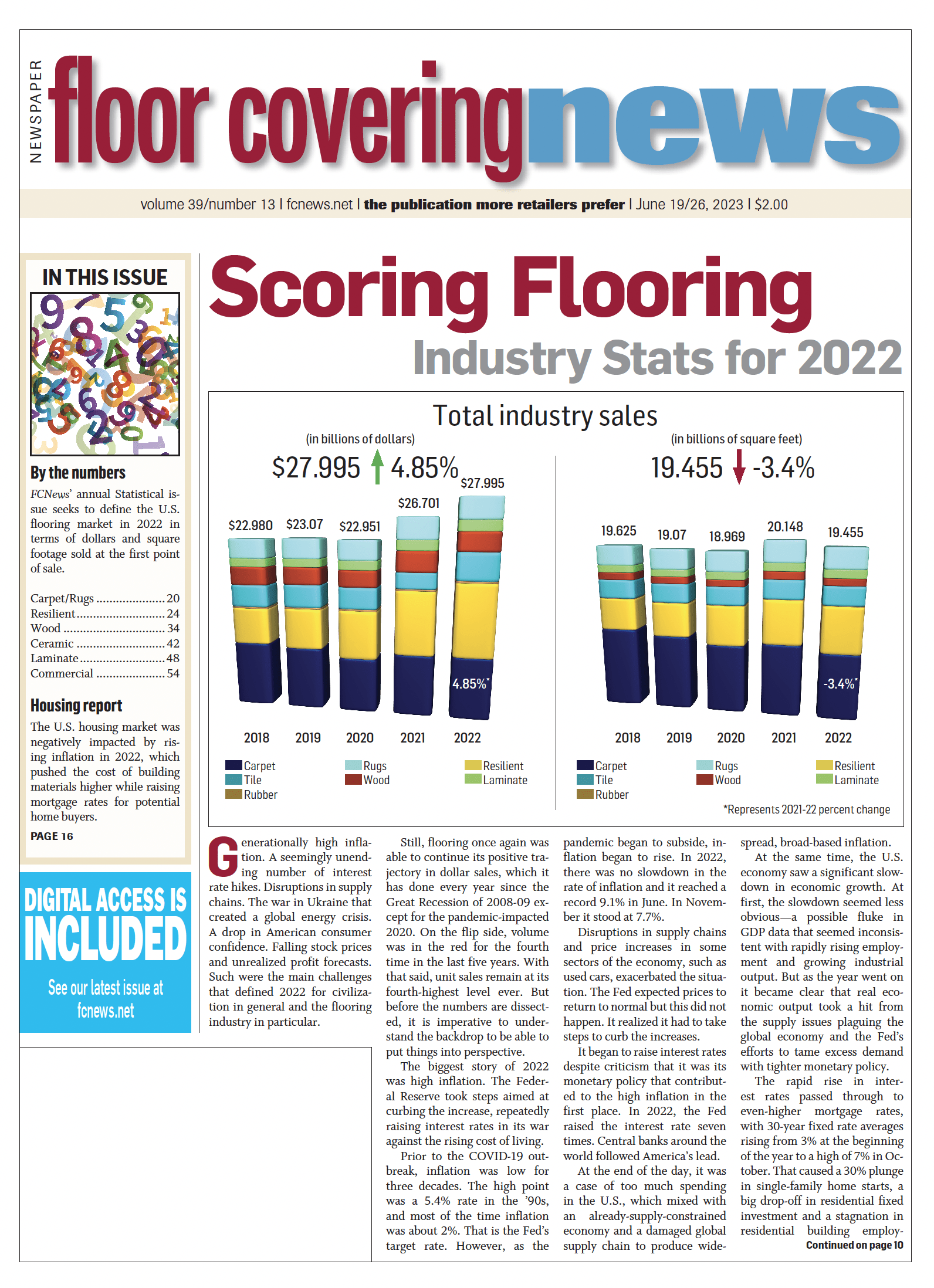

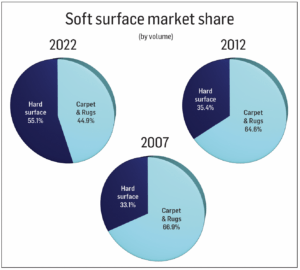

When all the numbers were tabulated for 2022, Floor Covering News research found that overall carpet sales grew a scant 0.5% to $8.242 billion compared with $8.201 billion in 2021. After increasing 17.2% in 2021, residential carpet sales fell 5.7% in 2022. Area rug sales (not including customized rugs from broadloom) decreased an estimated 4% to $2.67 billion.

Total carpet and area rug volume for 2022 was down 9.1% from 2021 to $8.76 billion. Despite the down year, the carpet/rug segment remains the largest category within flooring by volume, accounting for 45% of the overall 19.455-billion-square-foot flooring market in 2022.

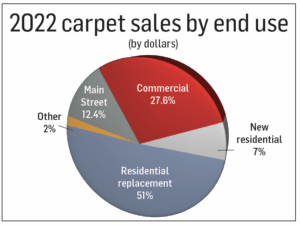

However, in a scenario that has repeated for over a decade, soft surface continued to cede market share to hard surfaces. To put things in perspective, 10 years ago (calendar year 2012), carpet/rugs commanded 64.6% of all flooring in terms of square footage. Fifteen years ago (2007 numbers), carpet/rugs accounted for 66.9% of the market in unit volume—a difference of 21.9 percentage points from 2022’s numbers. In real numbers, volume went from 15.21 billion square feet in 2007 to 8.76 billion square feet in 2022, a decrease of 42%. Not surprisingly, it was around 2007 that carpet slowly but surely transitioned from a whole-house, wall-to-wall purchase to a room-by-room selection. Meanwhile, hard surface became the primary flooring for the home. Mill executives estimate residential carpet makes up about 30%-35% of the home on average today.

The early days of 2022 saw a continuation of the strong market conditions that prevailed in 2021 when homeowners were spending money on home renovations, including flooring, while largely eschewing travel and entertainment. But as the pandemic loosened its grip on society, consumers returned to their normal spending habits, thus ending the magic carpet ride for many. “Carpet as a category was over-indexing in the post-COVID-19 era,” said T.M. Nuckols, president of the residential division, The Dixie Group. “[That period] was driven largely by the need for quieter home environments as more people were working remotely and more kids were doing online school from home. Then, in early 2022, three things began to happen that affected the consumer. First, inflation rose to 8% in the U.S.; the Federal Reserve began raising interest rates to control inflation; and the stock market lost 15% between end of 2021 and mid-’22. Rising interest rate hikes and continued inflationary pressures resulted in fewer single-family home starts. With all these things going on, consumers pulled back on discretionary spending, and home renovation—including flooring—felt the pullback.”

By Q2 , the residential replacement segment felt the effects of consumers pulling back as demand for flooring waned in the remaining seven to eight months of the year. “With many individuals coming back into the office and restrictions on COVID-19 continuing to minimize, consumers’ discretionary spending began to shift to other categories beyond the home,” noted Jason Surratt, president of Tarkett Home.

James Lesslie, COO of Engineered Floors, said the end of the pandemic was among the factors impeding soft surface. “There was also an impact with consumer confidence and the negative impact of home improvement losing its share of disposable income to travel. With the impact of inflation, there is more focus on value. During COVID-19, there was more focus on lifestyle and quality of life in the home.”

Pricing trends

Driven by inflation, which led to rounds of price increases during 2022, the average wholesale price of carpet jumped an estimated 10% from $1.06 to $1.17 ($10.53 sq. yd.). Hot spots within the residential sector were in that ASP range ($10-$14/sq. yd.) to the very high end at roughly $30/sq. yd. and above. “Higher-end goods continue to see growth as the consumer has a smaller footprint in the overall home of soft surface and is willing to spend a little more for the aesthetic she desires,” Tarkett’s Surratt added.

Despite the desire for higher-end carpet, observers say inflationary pressure has forced budget-conscious consumers to adjust their spending, creating a market for mid-tier offerings in the $12-$15/sq. yd. range. “With inflation, the average consumer is looking for value and choosing [less costly] lighter retail weights of 30 ounce to 40 ounce and more polyester due to lower raw material cost,” said Jamie Welborn, Mohawk’s senior vice president of product management, soft surface. “Fortunately, technology today has allowed us to make a much better performing carpet with much nicer design and style that’s more affordable.”

Despite the desire for higher-end carpet, observers say inflationary pressure has forced budget-conscious consumers to adjust their spending, creating a market for mid-tier offerings in the $12-$15/sq. yd. range. “With inflation, the average consumer is looking for value and choosing [less costly] lighter retail weights of 30 ounce to 40 ounce and more polyester due to lower raw material cost,” said Jamie Welborn, Mohawk’s senior vice president of product management, soft surface. “Fortunately, technology today has allowed us to make a much better performing carpet with much nicer design and style that’s more affordable.”

Encouraging signs ahead?

While industry estimates show residential carpet sales are down just over 10% in 2023 (year-to-date), there are encouraging signs ahead, executives say. At the macro level, market dynamics paint a more favorable landscape, ripe with opportunity for carpet mills. The National Association of Realtors (NAR), for example, reported that the U.S. housing market is short more than 300,000 affordable homes for middle-income buyers, about half of what it was in 2019. At the same time, U.S. housing stock is aging, with the average age of owner-occupied homes at 41 years, signaling a growing remodeling market. Moreover, rising home prices— and mortgage rates—are keeping homeowners from moving. “With housing shortages and more expensive housing finances, consumers are being forced to hold a home longer and are willing to spend more money for new styles and better quality,” said Chet Graham, co-CEO, Marquis Industries. “I don’t see pricing inflation affect carpet as other consumer products, as our categories are not a ‘routine’ purchase so the consumer doesn’t have a recent purchase history to compare.”

TDG’s Nuckols feels good about the high-end residential segment. “More housing must be built, and those homes will need floors. Part of those floors will be covered with carpet. From a price-point perspective, carpet is a bargain compared to most hard surface options. So, the consumer can get a nice, high-end carpet for about the same money as a middle-of-the-road hard surface product.”

Other executives suggest the trend toward hard surface—and the incumbent higher cost of installing any hard surface floor vs. a soft surface floor—also bodes well for carpet. “The consumer is now driven to purchase better carpet for the soft surface areas of her home,” said Don Karlin, vice president of sales and marketing for Nourison. “Carpet today offers so many design options. The soft surface segment is now the center of creativity in interior design.”

Other executives suggest the trend toward hard surface—and the incumbent higher cost of installing any hard surface floor vs. a soft surface floor—also bodes well for carpet. “The consumer is now driven to purchase better carpet for the soft surface areas of her home,” said Don Karlin, vice president of sales and marketing for Nourison. “Carpet today offers so many design options. The soft surface segment is now the center of creativity in interior design.”

Christine Zampaglione, senior director of marketing for Stanton, said carpet should no longer be viewed as an afterthought meant solely for comfort in the home. “Carpet is now considered a crucial element in the room to elevate the entire experience,” she said. “Accessibility to quality design through social media has truly empowered the consumer to make bolder choices in terms of color and pattern and how you can easily tie adjoining rooms and design aesthetics together with the right carpet options.”

With residential carpet largely sold on a per-room basis, industry observers say consumers are designing their spaces with intention and purpose from the ground up. “Consumers are mixing hard and soft surfaces throughout the home and placing carpet where they want to feel most comfortable—bedrooms, living rooms, stairs, etc.,” said Herb Upton, vice president, soft surface, residential, Shaw Industries. “New innovations in manufacturing allow us to create perfectly imperfect designs that provide one-of-a-kind appeal. While high-performance nylon is still widely used, preference for high-performance PET continues to increase in retail and builder/ multifamily due to technological innovations in fiber.”

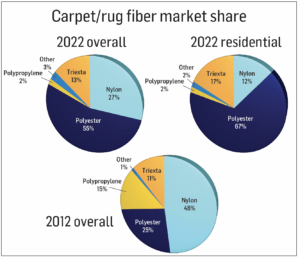

While some mills still say they believe very strongly in the premium features and benefits of nylon for carpet, solution-dyed polyester has become the standard of choice across most of the residential segment. Today, PET and PTT (triexta, Mohawk’s proprietary fiber) account for more than 80% of the residential business, according to industry estimates, with nylon in the 12% range.

Multi-family sector shines

With surging mortgage rates and home prices, renting is viewed by some as the better option for first-time home buyers, a boon for the multifamily sector. On average across the 50 largest metro areas in the U.S., a typical renter pays about 40% less per month than a first-time homeowner, based on asking rents and monthly mortgage payments, according to realtor.com. In December 2022, it was more cost effective to rent than buy in 45 of those metros, the real estate site found. That’s up from 30 markets the prior year. “In these difficult times, more people are renting, and carpet is still a great value,” Mohawk’s Welborn said. “And since price is so sensitive in the multifamily channel, a low-end hard surface doesn’t necessarily hold up (scratches, dents), so we’re not seeing as many turns as the owner wanted. Finally, the noise factor with carpet is much less and this helps in multifamily.”

Commercial

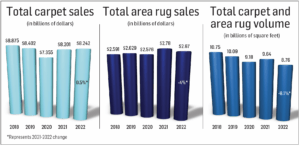

The pendulum has certainly swung favorably for commercial carpet. Just two years ago, both dollar sales and unit volume were down more than 20%, extending a five-year-losing streak. In 2022, however, commercial dollars grew 11.2%, contributing to the category’s overall 0.5% gain.

Floor Covering News estimates the commercial market at $3.32 billion for 2022 with specified contract sales at $2.535 billion and Main Street at $787 million.

[Note: For years, a large percentage of mills considered level-loop polypropylene a Main Street product, mostly installed in rental space/tenant improvement and low-end apartments and basements. Today, much of this business has been lost to low-end polyester cut piles. These cut-pile sales are reported as residential, not Main Street. As well, some mills break out Main Street from their specified business, for example, identifying smaller K-8 to K-12 schools as Main Street.]

For some, the rebound was not surprising as the commercial segment typically lags residential when rebounding from a catastrophic event such as the pandemic. This is because many commercial jobs are planned months out, and there is a pipeline that must be built and completed. Commercial has continued its positive ways in Q1 ’23, with sales increasing 14.8% vs. 2022, while volume climbed 4%, according to industry estimates.

While certain commercial segments have bounced back nicely since the pandemic (i.e., healthcare, education), the effects are still being felt in corporate as work-from-home and hybrid work schedules have left many offices vacant.

Area rugs

While traditional area rug sales among flooring dealers have waned, the move toward selling custom rugs has picked up. Increasingly, retail stores are fabricating custom rugs and stair runners by using their own workrooms or a third party; in other cases, the mills are doing the work. Five years ago, for example, an estimated 15% of broadloom sales went to rugs or stair runners; today that number is 20% and growing, according to reports. Of note, suppliers consider a fabricated rug from broadloom a carpet sale whereas many flooring dealers view it as a rug sale.