By Steven Feldman There is no denying that 2020 was a year unlike no other. The COVID-19 pandemic wreaked havoc across the globe, leaving destroyed economies and industries in its wake. Remarkably and fortunately, the U.S. flooring industry was spared—for the most part. As consumers were forced to cancel lavish vacations and were stuck at home staring at old decors, they pivoted to home improvements as the avenue to spend their money. Add that to “The Great Migration” as people moved away from big cities and into the suburbs and the result was an acceptable year for the flooring industry.

By Steven Feldman There is no denying that 2020 was a year unlike no other. The COVID-19 pandemic wreaked havoc across the globe, leaving destroyed economies and industries in its wake. Remarkably and fortunately, the U.S. flooring industry was spared—for the most part. As consumers were forced to cancel lavish vacations and were stuck at home staring at old decors, they pivoted to home improvements as the avenue to spend their money. Add that to “The Great Migration” as people moved away from big cities and into the suburbs and the result was an acceptable year for the flooring industry.

Up until this point, everything was anecdotal. Retailers and manufacturers were on pace for a record year after the first 10 weeks of 2020. Then business came to a grinding halt. And then when things picked up, things really picked up. The third quarter was strong; the fourth quarter was even better, setting the stage for what has already been an incredible start to 2021.

Sure, commercial business took a big hit. And carpet suffered mightily before rising like the mythical Phoenix in the second half of the year. The fourth quarter was the best this industry has seen since Hector was a pup. But soft surface remains overshadowed by the new darling—call it waterproof, rigid core or SPC; it’s the category that saved this industry.

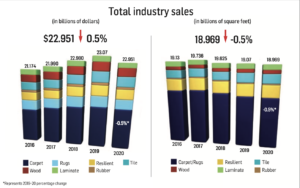

When the dust cleared and all the numbers were counted, total industry sales fell just short of 2019’s numbers at $22.951 billion, a decline of 0.5%. Coincidentally, that was the growth percentage in 2019, so all this industry did was give back the gains of one year ago. Sure, 2019’s growth in dollars was the lowest since 2009, when the industry declined significantly due to the Great Recession. But to just retreat to 2018’s numbers? We’ll take it.

Truth be told, had it not been for the resilient category in general and the waterproof subsegment in particular—which is basically carrying the floor covering industry on its back—things would not appear so rosy. It is becoming obvious that resilient is cannibalizing dollars from just about every other flooring category, all of which were either down slightly or significantly in both dollars and volume, with the exception of laminate, which very quietly is making the greatest comeback since Lazarus.

Not only did 2020 floor covering dollars escape the wrath of the pandemic, so, too, did square footage. And there are two ways to look at this: those who look at the glass as half empty can cite volume’s third consecutive year of decline following six straight years of increases. But those who look at the glass as half full will see that volume dropped only 0.5% from 2019 compared to the previous year’s decline of 3.1%. More positive news: square footage is still higher than the 2009-15 period and almost on par with 2006.

FCNews research reveals that carpet and rugs (which comprises 48.4% of industry volume, down from 52.9%) dropped approximately 828 million square feet (following a 660 million-square-foot dip in 2018), and not even the high-powered resilient segment can make up for that. But when you take soft surface out of the mix—and, yes, that is just about half the industry—volume of floor covering sold in 2020 was actually up 8%.

For the record, the industry was up about 0.4% in dollars and down 2.8% in volume in 2019. This comes on the heels of 4.6% growth in dollars and a decline of 0.6% in volume in 2018; 3.85% growth in dollars and 3.2% in volume in 2017; 5.1% growth in dollars and 3.8% in volume in 2016; and 4.4% and 3.2% growth, respectively, in 2015.

For the record, the industry was up about 0.4% in dollars and down 2.8% in volume in 2019. This comes on the heels of 4.6% growth in dollars and a decline of 0.6% in volume in 2018; 3.85% growth in dollars and 3.2% in volume in 2017; 5.1% growth in dollars and 3.8% in volume in 2016; and 4.4% and 3.2% growth, respectively, in 2015.

FCNews’ exclusive research reveals total 2020 flooring sales topped out at $22.951 billion and 18.969 billion square feet. It’s the third highest dollar count since 2006. (Note: These numbers are in wholesale dollars reflecting the first point of sale. They also do not include stone flooring, nor do they account for ceramic wall tile, cove base and rubber accessories.)

Some good news: The industry is not so far from the peak it reached in 2006, when sales of $24.175 billion were posted. Flooring currently sits just 5% below 2006’s dollar mark although 28.5% off in volume. What does that mean? More good news: Back then, the average square foot price of flooring was a shade under $0.92. Today, that figure is $1.21, up from $1.17 in 2018. Attribute that to better goods infiltrating the marketplace, favorable product mixes, more retailers using credit as a tool and, of course, the inability to spend on much else in 2020. Tariffs on Chinese-imported products also contributed, as did a series of price hikes as flooring suppliers saw increases in everything from overseas freight costs, containers and LTL carriers.

Let’s look at the industry in another way. When we entered this decade back in 2010, we were recovering from the Great Recession and flooring sales were $16.221 billion and 16.625 billion square feet. As we reached the end of the decade, the industry was up 42.2% in dollars and 14.3% in volume. So the average selling price of one square foot of flooring has increased $0.235 in the last 10 years.

Another thing to keep in mind about the numbers: Ten years ago, FCNews included cove base and accessories in its rubber flooring numbers. Four years ago, we made the decision to include only sheet and tile flooring in our rubber numbers and only adjusted back to 2012. In the absence of that change, 2020’s volume could have eclipsed 2007’s volume figures.

As mentioned, the average selling price of all flooring in 2020 was $1.21, the same as in 2019 and up from $1.17 in 2018 and $1.11 in 2017. Three years ago, price increases drove the rise, particularly in carpet and wood, most noticeably on red and white oak species. But in 2020 it was not only about price increases but consumers gravitating to better goods. Hardwood continues to benefit from a shift that started a few years ago away from less expensive Chinese imports to pricier domestic goods and imports from Europe.

A closer look at the resilient category over the last 14 years illustrates the rise in average selling price. Back in 2006, the ASP for all resilient flooring was $0.64. In 2017, it was $1.04. It was up a dime in 2018. Add another nickel in 2019 and two more cents in 2020. So, now we are at $1.21. A decade ago, sheet vinyl, vinyl composition tile (VCT) and the low-cost, peel-and-stick tile commanded 75% of dollars. Last year, that number plummeted to 14.7%, down from 19.7% in 2019 and 22.5% in 2018. (In terms of volume, that number is a more healthy 33% but down from 40% in 2019.) The increased usage of the rigid/waterproof category has been an industry game changer.

But it’s not just resilient. The average ceramic tile price has increased from $0.95 to $1.18 per square foot over the last 11 years, and hardwood has seen an average-square-foot price jump from $2.36 to $2.49 per square foot. Even the maligned soft surface segment—which has seen its share of market dollars dip from 61.2% in 2010 to 43.2% in 2020 (down from 47.8% in 2019)—has seen an increase in average pricing from $0.90 to $1.08.

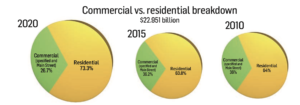

In terms of channels, needless to say the flooring industry was led by residential with the Home Depots, Lowe’s and Floor & Decors leading the way. Home centers were allowed to stay open during the early days of the pandemic as essential businesses and capitalized while many independent retailers were forced to shut their doors. However, after a month or two, states started lifting restrictions—some earlier than others—and specialty retailers were bombarded with consumers who were focused on home improvements.

Commercial was a challenge, particularly on the carpet side, where industry statistics have it down nearly 22% in dollars. With corporate being the largest chunk of commercial, coupled with carpet’s strong position there, this segment was most impacted by COVID-19 as states required offices to be shuttered for the better part of a quarter or half the year. As many businesses adopted work-from-home policies, corporate may suffer for the foreseeable future.

Multifamily also took a major hit as well, primarily due to a moratorium on evictions that remains in place until the end of June. That translated into much fewer turns than years past and, thus, fewer floor covering jobs. Remember, the rental market often comprises lower-income families, and they were obviously impacted by the pandemic more so than others. It is estimated that the multifamily segment dropped between 40% and 45% in 2020, but the thought is that this piece of the business has brighter days ahead.

There were other positives in 2020 aside from residential replacement. The housing market was solid, both in terms of new and existing homes. The year started out strong, then slowed to a crawl in March when COVID-19 hit. But the slowdown was short lived as the market rebounded quickly. With people working from home and children in remote learning mode, there was a need for bigger spaces as families sought more square footage. At the same time, with families having to spend more time at home, there was a migration away from cities to suburbia where people could take advantage of outdoor spaces. And there were those who sought refuge in states with fewer restrictions like Florida and Texas.

If we look at the numbers, the first two months of the year had the highest seasonally adjusted rates for existing home sales in 12 years. Sales fell off a cliff for the next three months but rebounded in June, a trend that continued through the end of the year.

Carpet

2020 was a tale of two halves for the carpet segment. The second half for residential showed more strength and growth than at any three-month period since before the Great Recession, as dollar sales jumped 13.2% in the fourth quarter (9.5% volume). Alas, just as there are four quarters in a football game, 2020 had four quarters as well—with the second quarter posting a whopping decline of 27.4% in dollars and 23.1% in volume for residential. Combined with commercial’s bad year overall and carpet was down for the year.

2020 was a tale of two halves for the carpet segment. The second half for residential showed more strength and growth than at any three-month period since before the Great Recession, as dollar sales jumped 13.2% in the fourth quarter (9.5% volume). Alas, just as there are four quarters in a football game, 2020 had four quarters as well—with the second quarter posting a whopping decline of 27.4% in dollars and 23.1% in volume for residential. Combined with commercial’s bad year overall and carpet was down for the year.

Despite this, carpet still remains the largest flooring seg- ment, accounting for 48.4% of the overall 18.969 billion square foot flooring market in 2020. And although carpet’s lead over hard surfaces shrinks every year, there was some thought among executives that the rate of decline was flattening.

Where carpet has fared well is at the higher end, with wholesale prices starting at $15 and up. Two reasons for this: homeowners are no longer purchasing carpet for their entire homes; it is mostly on a room-by-room basis, and as such consumers are willing to pay for premium carpet; No. 2, the quality of carpet is just better than it was five years ago, and consumers love the look and feel and durability, thanks to advances in fiber technology and processes that are delivering more patterns and vibrant colors than ever before.

So where does carpet go from here? Well, just as the overall flooring market burst out of the gate in 2021, so has carpet. Many retailers say they are having their best years ever with carpet, as the rally that began in the second half of 2020 continues through at least the first four months of 2021. The encouraging takeaway for mills and their retail partners is that consumers are willing to give carpet a second chance after years of opting for hard surfaces.

Resilient

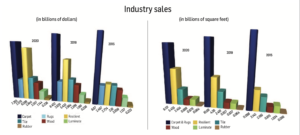

Much like the past few years, the resilient category continues to be the locomotive powering the industry, with rigid core serving as the catalyst for this explosive growth in 2020. Last year, resilient (not including rubber flooring, which checked in at $236.5 million) carried the industry on its shoulders, posting its only appreciable gains, rising 21.3% to $6.589 billion from $5.433 billion in 2019. Since 2010, the category has increased a stunning 285% and is now at its highest point in history in terms of dollars. Interestingly, it has “only” increased 130% in volume, again accentuating the migration from residential/commercial sheet and VCT to WPC/rigid core and the transition from felt- backed products to fiberglass sheet.

In the grand scheme of things, resilient now accounts for 28.8% of the total flooring market in dollars and 28.8% in volume (up from 23.9% in 2019) after a 19.5% rise in units to 5.455 billion square feet. In 2019, resilient held a 23.6% market share in terms of dollars, which was up from 21.4% in 2018, 18.2% in 2017, 16.5% in 2016; and 13.3% in 2015. Interestingly, its market share in volume had stayed around 15% for eight consecutive years until leaping to 17% in 2015; 18.8% in 2016; 20% in 2017; 22.3% in 2018; 24% in 2019 and now 28.8%.

FCNews research reveals just how much rigid core is driving growth of the segment. Last year, rigid core checked in at $2.668 billion and 1.64 billion square feet. That translates into 48.5% of resilient’s dollars and 45.3% of its volume. To put this in perspective, total LVT sales just five years ago were $1.45 billion. So, rigid core alone is nearly double the entire LVT market in 2015.

The category that is losing significant share within the LVT segment is flexible click. Case in point: In 2018, flexible click checked in at $497 million and 384 million square feet. Those numbers dropped to $127.6 million and 94 million square feet in 2020. That’s a dip of 74.3% and 75.5%, respectively.

Yes, rigid core and WPC have taken on a life of their own over these last few years, although rigid core has become the star of the show. Even WPC, which had spread like wildfire for a number of years, finally met its match. While WPC grew to $1.18 billion and 563 million square feet at its peak in 2018, those numbers dipped in 2020 to $932 million and 445 million square feet in 2020. About 95% of WPC applications are on the residential side.

But no matter how you slice it, WPC and rigid core dominated the residential resilient market. These two categories account for 80.1% of all residential LVT sales (up from 66%) and 70.2% of all residential resilient sales (up from 56.2%). They also account for 65% of total LVT sales.

WPC and rigid core are not major players on the commercial LVT side, which remains a glue-down market. Glue down represents 70.5% of the $1.3 billion in sales and 75.4% of the 757 mil- lion square feet. Loose lay also has a nice presence here, representing 12.3% of commercial LVT sales and 8.8% of volume.

As LVT grows, it is taking share from other resilient cate- gories, especially VCT, which today is only 2.9% of resilient dollars and 6.3% of volume. Eight years ago, those numbers were 19.7% and 26.8%, respectively. FCNews estimates the VCT market to be about $191 million and 342 million square feet. But it is also nipping share from sheet vinyl as well. Sheet vinyl—residential and commercial combined—has declined 20.4% in the last five years, going from $813.5 million in 2015 to $647.5 million in 2020. The residential sheet market dropped 10% in 2020 from $500 million to $451 million. Volume dropped 8.1%, which signified price pressures. The commercial sheet market declined 11.7% in 2020 with esti- mated sales of $196.5 million vs. $222.5 million in 2019. Volume dropped 9.9% from 106.5 million square feet to 96 million square feet. It remains a mainstay in health care, where a more seamless floor covering is demanded. The category has been a chal- lenge for just about everyone, with heterogeneous continuing to take share from homogeneous—a segment that really has only three players remaining: Armstrong Flooring, Mannington and Tarkett.

Ceramic tile

Continuing its downward trajectory, the tile category experienced a low, single-digit decline in terms of overall dollar sales and a similar decline in terms of volume. In comparison, ceramic tile had experienced low, single-digit growth in several consecutive years prior.

Continuing its downward trajectory, the tile category experienced a low, single-digit decline in terms of overall dollar sales and a similar decline in terms of volume. In comparison, ceramic tile had experienced low, single-digit growth in several consecutive years prior.

FCNews research shows the category saw about a 5% decline in dollar sales to $2.844 billion in 2020 from $2.994 billion the previous year. Volume also experienced a drop off, registering about a 3.5% decline to 2.403 from 2.491 billion square feet in 2019.

In the grand scheme of things, the tile category still held strong as the third-largest sector in flooring, representing 12.4% of total industry dollars in 2020 and 12.7% of volume, down slightly from 13% of dollars and 13.11% of volume in 2019.

In 2020, the category also represented 21.8% of dollar sales for the gradually increasing hard surface market and 24.6% of volume. That is down from 24.86% of dollar sales and 30.98% of volume vs. 2019.

It will come as no surprise that most ceramic tile suppliers pointed to the COVID-19 pandemic as the overarching challenge in 2020. In fact, the first quarter even showed growth projections before initial shutdowns and uncertainty took hold. “COVID-19 was the largest impact on overall demand,” Raj Shah, president, MSI, explained. “The industry was growing by 3%-5% in [the first quarter of 2020] prior to COVID-19. In the second quarter, COVID-19 virtually turned off the industry outside of a couple of big box retailers. The third quarter started the rebound, but it was not until the fourth quarter when the industry stabilized.”

Another ongoing challenge for the category is finding qualified labor. Tile flooring, more so than most others, requires installation by highly trained and even artisanal tradespeople. That installation can also take several days or even weeks depending on the scope and scale of the project. This pre-existing challenge was affected by the pandemic as homeowners grew wary of professional installers inside their homes—especially for extended periods.

The culmination of these installation challenges could have pushed some consumers from the tile category into those that allow for easy installation or cater to the DIY community, namely resilient flooring.

Despite these challenges, suppliers say growth is expected moving forward. The pandemic may have caused challenges, but it has also put new opportunities in place that are ready to be tapped.

Hardwood

The hardwood flooring category continued to feel the effects of the rising popularity of competing wood look-alike alternatives in 2020, as the segment took another hit for the second year running. FCNews research shows the U.S. hardwood flooring market generated approximately $2.207 billion in sales, a 4% decrease from 2019 and a shade below the five-year low of $2.23 billion achieved in 2015.

In terms of volume, the wood flooring segment accounted for roughly 888 million square feet—a decrease of 4.2%. That’s the lowest level seen since 2015, when the category accounted for just over 850 million square feet.

While hardwood still represents the third-largest hard surface category behind resilient and ceramic with respect to sales, the gap continues to widen. In 2020, hardwood flooring accounted for 17% of all hard surfaces sold at the first point of distribution—that’s down from about 20% just two years ago. Volume-wise, hardwood flooring actually came in fourth place behind laminates—which slightly edged out hardwood by less than 1 percentage point.

Taking soft surface into account, hardwood represented 9.6% of the total flooring market in 2020 in terms of dollars. Compared to five years ago, hardwood represented just over 10% of the market. With respect to total volume, hardwood represented 4.7% of total square footage sold in 2020. That’s fairly consistent with wood’s standing in 2015 and 2010 with respect to volume.

Along with the gradual loss of market share, the hardwood flooring segment also experienced shifts in channels of distribution in 2020. FCNews research shows home centers increased their share of the pie from 35% to 38%, while specialty retailers saw their share slip slightly from 32% down to 30% of sales. Direct-to-consumer sales rose slightly, mostly on account of aggressive marketing by online outlets and discount stores.

The X factor that drove sales across those channels that saw higher wood consumption was clearly the pandemic. Like many other aspirational home improvement categories that benefitted from consumers spending much more time at home, the North American hardwood flooring sector also reaped the rewards. Suppliers across the board attested to the positive impact that the novel coronavirus had on purchases and installations of wood flooring.

Laminates

Preliminary reports pegged laminate flooring sales at the first point of distribution in the U.S. at $1.144 billion, a 5.8% increase over 2019. The volume of laminate flooring sold also grew, by 4.2%, to 976 million square feet, according to preliminary FCNews research. For most other categories, that wouldn’t be such a noteworthy accomplishment. But given last year marked the first time in the past five years that the U.S. laminate market actually grew, it was newsworthy.

Anecdotal information suggests the higher ratio of sales growth to volume increases indicates more product was sold in the thicker, 10mm-12mm range vs. the thinner, entry-level 7mm- 8mm offerings often found at discount merchants and big boxes.

The growth in sales and volume slightly increased laminates’ share of the total flooring market to roughly 5% of sales—up slightly from 4.7% of the total flooring market in 2019. However, that’s down from 2015, when laminate flooring accounted for about 5.6% of both total flooring sales and volume. But it’s off more significantly from 2010, when laminate accounted for 6.9% of dollars and 6.1% of volume.

The change in laminates’ share of total hard surfaces was negligible year over year. In 2020, the category represented 8.7% of hard surface sales, consistent with 2019 despite the category’s growth spurt last year. That makes it the fourth-largest hard surface category by value. With respect to volume, laminate flooring slightly decreased its share of total hard surface square footage sold to nearly 10%. That’s down slightly from about 10.4% in 2019.

The strong performance of the nation’s leading home centers and big boxes contributed mightily to the increase in laminate flooring sales in 2020. FCNews research shows Home Depot, Lowe’s and Menard’s accounted for more than 63% of laminate sales in the U.S. last year—that’s up from 59% the year prior. Industry observers concur that the strong performance by the big boxes last year was due in large measure to their “essential business” status amid the early days of the novel coronavirus. During a time when most were sequestered, home centers took full advantage of a captive retail audience. This competitive advantage had a direct impact on home centers’ laminate sales.

Methodology

The statistics presented in this study were derived from an extensive research project undertaken by Floor Covering News. Figures were gathered from a variety of sources to develop the most plausible and credible results at the time of publishing.

Within every category, FCNews held numerous private conversations with high-ranking executives from many of the industry’s leading mills, groups and associations about the overall industry and their respective segment(s) of business. While these discussions were off-the record and confidential, the information gleaned from them was incorporated into the research to help arrive at the final figures.

Other sources included, but were not limited to, published government records (both U.S. and foreign sources); filings from publicly held companies; extensive and confidential inter- views with top officials from all levels of the supply chain; historical trends and data; reports published by associations along with private conversations with directors; and previously published reports and stories in FCNews and other credible media sources.

Some of the data came from sources such as the U.S. Department of Commerce and other federal agencies. Information was also gathered from foreign agencies and respected international groups affiliated with flooring.