The word “unprecedented” has aptly described the unexpected growth the flooring industry experienced in 2021 despite supply chain challenges, rising costs and the ongoing effects of the pandemic. What is not unprecedented is the trailblazing resilient category, which continued its wild ride in 2021 with another year of major growth in both resilient flooring sales and volume—again led mostly by the red-hot rigid core subsegment of LVT.

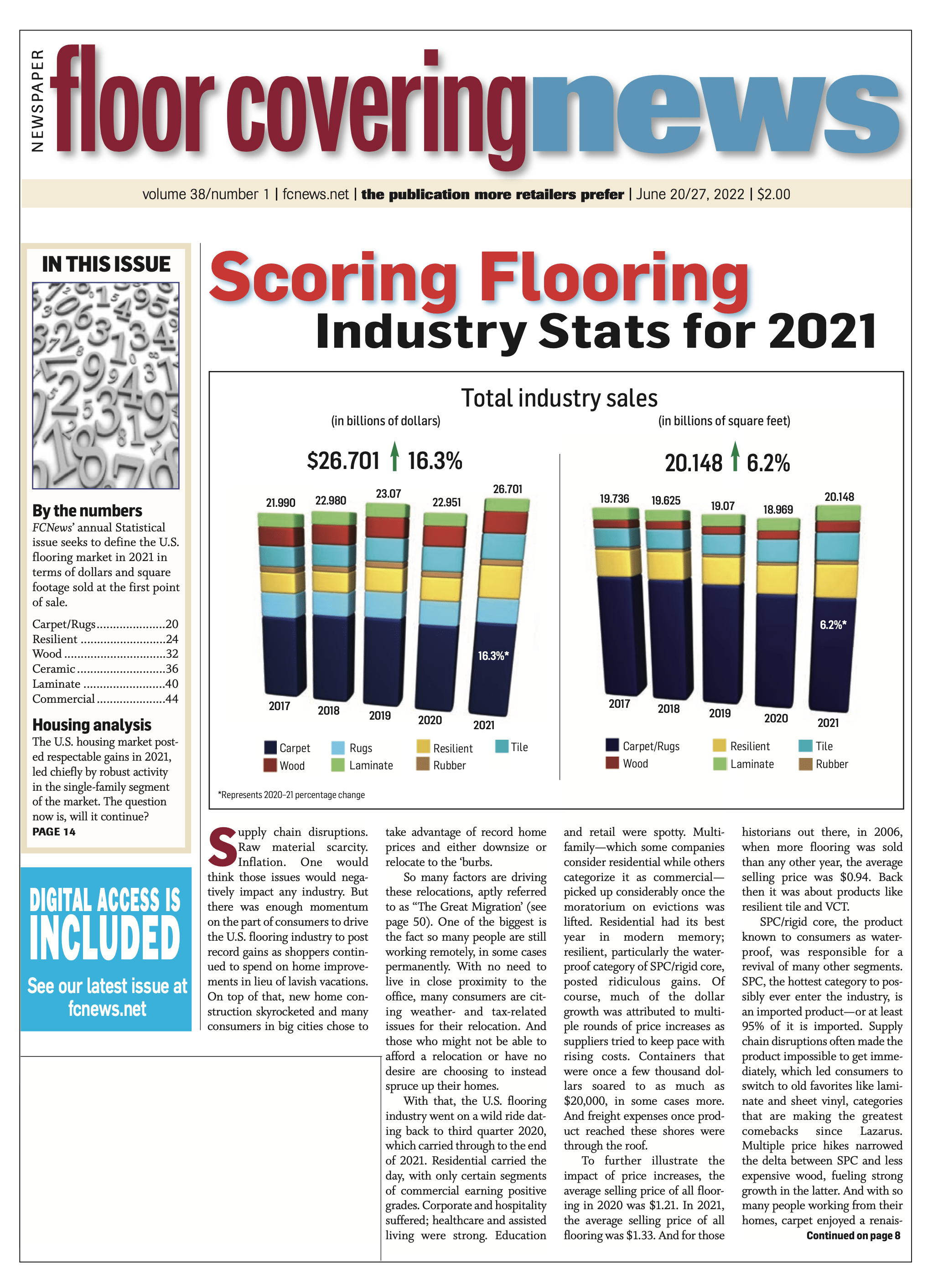

FCNews research shows resilient flooring sales as a whole generated $8.426 billion (not including rubber) in 2021, culminating in an industry-leading 30.3% increase over 2020’s revised $6.463 billion. In terms of volume, the category accounted for 5.881 billion square feet (not including rubber) at the first point of sale, a 9.8% increase from 5.357 billion square feet in 2020.

When taking total flooring sales into account, resilient flooring sales comprised 31.6% of total dollar sales and 29.2% of volume compared to last year’s 28.7% of dollars and 28.8% of volume. That was up from 23.6% in 2019; 21.4% in 2018; 18.2% in 2017; 16.5% in 2016; and 13.3% in 2015. Over these last several years, resilient’s share of the market has more than doubled in terms of dollars and increased by nearly half in terms of volume.

Resilient’s strong performance in 2021 is even more clear when measured against the overall hard surface market. When compared to ceramic tile, hardwood and laminate, resilient accounted for 53.6% of dollar sales (and 55.9% in volume), versus 2020’s 50.6% in sales and 2019’s 45.1% in sales.

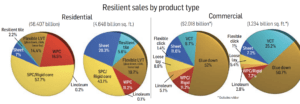

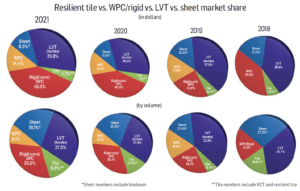

Of course, it’s the rigid core subsegment of the resilient category that is driving the overall growth. FCNews research shows that rigid core/SPC garnered 45.6% of total resilient sales in 2021 and 34.8% of volume. That translates to $3.845 billion in sales and 2.047 billion square feet. Compare that to 2020 when rigid core/SPC checked in at $2.617 billion and 1.63 billion square feet. To put this in perspective, total LVT sales just six years ago were $1.45 billion. So, rigid core alone is nearly triple the entire LVT market in 2015.

Rigid core/SPC is still considered a residential product and that is where it shines. (Commercially it finds growing favor in hospitality.) While glue-down LVT and WPC still command decent shares of the residential market, the popularity of rigid core/SPC is unmatched. FCNews research shows residential SPC grew from 52% in total resilient residential dollars to 56.9%. That equates to a whopping 48.1% increase in residential dollars in 2021 vs. 2020.

In terms of its command of the residential LVT segment in which it resides, 2021 saw an increase from 58.9% to 60.2%. Specifically, it generated $3.643 billion of the LVT market’s $5.785 billion in 2021.

The ongoing positive momentum, executives say, was the direct result of lingering effects of the pandemic, the housing market boom and the category’s features and benefits. “COVID-19 was a significant contributor to the strong residential remodel business,” David Sheehan, vice president, residential hard surface, Mannington Mills, told FCNews. “During the first half of the year, consumers were fixated on home improvement projects as many were forced to stay home from work.”

Discretionary income was shifted from travel and entertainment to home improvement projects. There was also a major shift from urban areas to suburban areas, and this also had an impact on the remodel business. As the fastest growing segment in flooring, resilient flourished in this environment and continued its share gain versus other categories.

Discretionary income was shifted from travel and entertainment to home improvement projects. There was also a major shift from urban areas to suburban areas, and this also had an impact on the remodel business. As the fastest growing segment in flooring, resilient flourished in this environment and continued its share gain versus other categories.

Executives agreed that housing had a strong influence on the market in 2021. “Housing remained strong, and people were still spending a lot of money there,” Adam Ward, vice president, resilient, Mohawk, told FCNews. “There was maybe [fear of missing out] happening as well—the ‘If I don’t buy this house remodel now, I might not be able to.’ So that helped drive sales. Plus, more people were buying houses, they were moving, home builders were continuing to sell well. So, all those factors [fueled] the growth that continued in 2021 and had started in 2020.”

Another lingering effect from the pandemic was the economic relief some consumers received in the form of stimulus checks, which became a boon to the flooring industry as consumers then focused on home renovations and remodels. “The government really injected a lot of stimulus money back into the economy the past 24 or 28 months,” said Jeff Francis, hard surface category manager, resilient, Shaw Industries. “And a lot of that stimulus money actually got released back into the market, which we benefited from.”

Even suppliers who traditionally focus on other categories saw the value in resilient. AHF Products, for example, entered the resilient segment in 2021 amid strong growth rates. “Vinyl has become a very, very important category for us,” Brian Carson, president and CEO of AHF Products, told FCNews. “We sell now to distribution, to large direct retailers and national retailers, and we sell to some of the largest home-builders in America. That’s all happened in 18 short months and we’re just getting started. The market has certainly cooperated, and SPC is taking share. The growth has been absolutely fantastic.”

However, suppliers note, it hasn’t been an easy road. The resilient category was hit hard in 2021 with significant supply constraints and ongoing challenges. In fact, some suppliers posit that the category’s growth, albeit significant, was stymied in 2021 by these challenges. “While resilient’s growth was staggering in 2021, it could have actually been significantly larger had it not been constrained by supply chain issues both domestically and from abroad,” Mannington’s Sheehan said. “Access to raw materials and logistical impairments limited the category’s growth.”

Residential

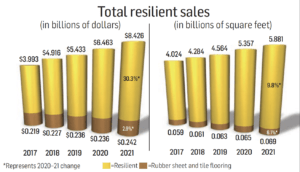

FCNews research shows the residential market made up about 76% of total resilient revenue or $6.407 billion in sales versus 72.1% of total resilient revenue or $4.722 billion in sales in 2020. With respect to volume, residential resilient accounted for about 79% of square footage shipped or 4.648 billion square feet, versus 76.8% of square footage shipped or 4.114 billion square feet in 2020.

The residential segment was supported in large part by the housing market boom. Despite supply chain and labor issues, new home starts rose for the 12th consecutive year and were at their highest point since 2006, according to the U.S. Census Bureau. The 1.6 million units started in 2021 represented a 16% gain over the 1.38 million total from 2020. Single-family starts in 2021 totaled 1.12 million, up 13.4% from the previous year, while multi-family starts in 2021 grew 22.1% compared to the previous year, according to the National Association of Home Builders.

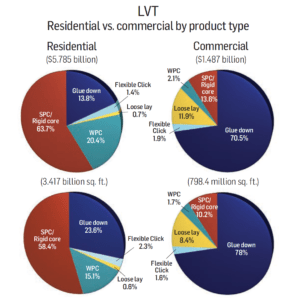

The bulk of the resilient category’s activity was driven by residential LVT (including glue-down, flexible click, loose lay, SPC, WPC and a relatively new sub-segment called mineral core), which generated an estimated $5.785 billion in 2021, versus $4.177 billion in 2020. That’s a gain of 38.5%. In terms of volume, residential LVT accounted for 3.417 billion square feet, up from 2.835 billion square feet in 2020 for an increase of 20.5%.

Two housing market segments continued to help drive that growth exponentially: residential remodel and single-family new construction. Suppliers agreed single-family was the shining star in 2021. “Obviously, during the market expansion, interest rates remain relatively low, which makes new housing and that segment of our business in particular very, very ripe for growth,” Shaw Industries’ Francis said. “New home construction, [throughout 2021], continued to have double-digit growth quarter over quarter.”

Nate Hohenstein, director of strategic accounts, Novalis, added that the large increase in home prices as well as the competitive nature of the buyer’s market caused two direct factors that influenced the flooring segments the most. “No. 1,” he said, “people didn’t want to overspend on homes, so they chose in many cases to remodel/renovate their own homes—in many cases taking advantage of interest rates and refinancing to do so. In other cases, where people did sell, they chose not to repurchase but to rent instead. This drove up the higher-end rental market and caused more renovation to be done in that space.”

However, some suppliers argue housing could have buoyed growth even further if the resilient category didn’t have to contend with supply chain challenges. “Residential remodel was really the primary driver for all flooring growth in the industry,” Mannington’s Sheehan explained. “While the number of starts for single-family builder were impressive, the gap between starts and completions limited this segment’s growth—supply chain issues for all building materials com- pounded in builder and limit- ed the growth of this segment.”

Residential breakdown

Within the residential market, LVT and sheet products remain viable options for consumers. And while there are several options from which to choose within the LVT segment, the resilient category is propped up by one main LVT subsegment: rigid core.

While flexible LVT products and the newer WPC still command decent shares of the market, it was rigid core/SPC that again took the lead in 2021. FCNews research shows residential SPC grew from 52.1% in total resilient residential dollars to 57.4%. That equates to a whopping 47% increase in residential dollars in 2021 vs. 2020.

In terms of its command of the LVT segment in which it resides, 2021 saw an increase from 59.2% to 63.7%. In terms of dollars, it generated $3.699 billion of the LVT market’s $5.807 billion in 2021.

Suppliers agree the SPC subsegment of LVT is increasingly more attractive due to its three main features—performance, aesthetics and price of entry. “It meets what I’ve called the ‘sweet spot’ of the consumer’s budget,” Mohawk’s Ward explained. “For the majority of the population, it’s an attractive price point. From a feature standpoint, it’s waterproof. That’s a big selling point of the category. And it looks nice. It also performs for the active household. The scratch resistance, durability, ease of installation—all those things are important to the customer and the category delivers on it.”

Suppliers agree the SPC subsegment of LVT is increasingly more attractive due to its three main features—performance, aesthetics and price of entry. “It meets what I’ve called the ‘sweet spot’ of the consumer’s budget,” Mohawk’s Ward explained. “For the majority of the population, it’s an attractive price point. From a feature standpoint, it’s waterproof. That’s a big selling point of the category. And it looks nice. It also performs for the active household. The scratch resistance, durability, ease of installation—all those things are important to the customer and the category delivers on it.”

Shaw’s Francis agreed. “The growth in the flooring industry is really in resilient and really in rigid core. The rigid products that we see in the market continue to drive all the growth. Relatively speaking, our glue-down business and sheet business—yes, they grew, but it’s not as much as we grew in rigid. The innovation in the platform, along with the performance, ease of installation and, candidly, just the affordability of it, is what continues to drive consumers to the platform.”

In addition to traditional SPC, there is a new breed of waterproof rigid core flooring beginning to make waves. Hybrid constructions now tout “real wood” veneers on top of waterproof SPC constructions, marketed as giving the consumer the best of both worlds. “SPC hybrids, those with natural hardwood or bamboo wear layers, represent the next generation of engineered flooring,” said Richard Quinlan, vice president of sales and marketing, Wellmade. “Consumers gain the natural beauty of ‘real hardwood’ in a floor that touts waterproof performance, installs without acclimation and remains stable in the most demanding installations.”

While this version of SPC is still too small to warrant a breakout in FCNews’ Statistical Issue, it is a new category worth watching.

SPC’s sister-subsegment, WPC saw a respectable gain in dollar sales in 2021. Much of that came from Floor & Decor. FCNews pegs the category at slightly under $1.2 billion and 520 million square feet.

For Mannington, the single-largest domestic supplier of WPC, the subsegment remains a viable part of the LVT market. “Most definitely it is an important part of our offering,” Sheehan said. “While SPC is indeed growing faster, we see a viable trade-up position for WPC and will continue to make investments in this area.”

Shaw, which has a significant stake in WPC with its COREtec brand, said it also continues to find value in the WPC construction. “We are a huge proponent of WPC, and we believe the product is going to continue to perform in the market as we move through the next couple years,” Francis explained. “It’s challenging because the cost to manufacture that product, compared to some other entry-level SPCs, puts it at a disadvantage, but there are still things we can do to WPC that we can’t achieve with SPC. And I think that’s what makes it viable.”

Glue-down LVT experienced a 15.5% increase in dollars in 2021 and 8.3% growth in volume (residential and commercial combined), which can be explained somewhat by price increases. The subsegment’s market share also dropped from 16.7% to 13.8% of 2021’s much larger residential LVT pie. Flexible click LVT, on the other hand, experienced a 21.6% drop in dollar sales in 2021 vs. 2020 and is becoming obsolete due to the more popular rigid products. Flexible click never took hold on the commercial side, and from a residential standpoint, those who want a flexible product are opting for glue down.

Glue-down suppliers noted the likelihood of growth within the segment to be directly related to supply issues that negatively impacted the booming rigid core category. “For Karndean in 2021, glue-down LVT had strong double-digit growth,” said Bill Anderson, the company’s CEO. “We do believe this took share internally from rigid, but likely because we offer a selection of colors and designs in both glue-down and rigid formats, it’s likely that due to some logistics delays with rigid that some opted for the glue-down format to meet timelines. Other contributing factors include the ability to individually replace glue down and loose lay pieces and that these formats do not require transitions.”

While some suppliers say click LVT is not dead, others point to its continual loss of share to rigid core. “We don’t see nearly as much of that anymore,” Mohawk’s Ward explained. “The advantages of SPC, namely the ability to go over those more uneven subfloors, the higher rigidity, less indentation—all of those present a little more attractive option for those customers looking for clickable product.”

The surprise win within the residential resilient category for 2021 was residential sheet. According to FCNews data, residential sheet experienced a nearly 13% gain in dollars and a 5.4% gain in volume. That is representative of price increases across the board. The gain can also be attributed to the supply chain challenges with rigid core in 2021. Residential sheet has long been considered a value product for the residential market, and suppliers agreed it was sheet’s availability—and the fact it is produced domestically—that added to its value in 2021. In addition, vinyl sheet has always been a mainstay in manufactured housing and RVs, and both segments enjoyed a strong 2021.

“With the high level of remodel business in 2021, residential sheet grew in 2021,” Mannington’s Sheehan explained. “The category continues to be the most affordable option. No other flooring category provides the aesthetic and waterproof advantages at the value of residential sheet vinyl.”

Mohawk’s Ward agreed. “Sheet did well in 2021. You really saw a lot of movement, particularly in builder and multi-family as they needed more product. The fact that it’s domestically produced was a strong selling point for sheet in 2021 against all the supply chain challenges. In terms of growth prospects in the future, we don’t see that suddenly starting to take back share, but we don’t necessarily see it losing a lot of share, either.”

Commercial

When it comes to the commercial market, the resilient category generated $2.018 billion and 1.234 billion square feet in 2021 versus $1.756 billion and 1.253 billion square feet in 2020. Flexible LVT remains the most important product category for the commercial market, and glue down is the workhorse.

Other categories are gaining ground within the commercial market, although they command nowhere near the same amount of market share as glue down. Rigid core, for example, including SPC and WPC, has grown at the expense of loose lay and click products.

When it comes to market segments, commercial flooring suppliers say multi-unit housing, education and healthcare were the drivers of growth in 2021. “In commercial, multi-unit housing boomed and education and healthcare showed solid growth/recovery to pre-pandemic levels,” said Denis Darragh, vice president, Forbo Flooring North America. “Hospitality and office, while showing some recovery, still have not fully recovered. Growth relative to 2020 is across the board. If you didn’t grow significantly in 2021 you have problems.”

When it comes to market segments, commercial flooring suppliers say multi-unit housing, education and healthcare were the drivers of growth in 2021. “In commercial, multi-unit housing boomed and education and healthcare showed solid growth/recovery to pre-pandemic levels,” said Denis Darragh, vice president, Forbo Flooring North America. “Hospitality and office, while showing some recovery, still have not fully recovered. Growth relative to 2020 is across the board. If you didn’t grow significantly in 2021 you have problems.”

Catherine Del Vecchio, vice president of marketing for the flooring division at American Biltrite, noted that the education market rebounded in 2021 versus 2020 (double-digit growth) almost to 2019 results, but the deliveries were much later in the second half of the year. “Our backlog of education projects reached record levels by the end of 2021 and continues to be strong in this first half of 2022,” she said. “Our product demand and deliveries have been very steady for the healthcare market between 2020 and 2021, simply reflecting the steady construction and renovation of this segment.”

Jeremy Whipple, vice president of business development at Novalis, noted that the 2021 commercial market saw its rebound start from the pandemic, and this rebound continued by growing stronger into 2022. “The largest growth areas were in multi-family and hospitality. The tremendous boom in the residential housing market also positively affected the commercial apartment and condo market, i.e., multi-family. So, you saw a tremendous amount of property development and growth in 2021 in that sector.”

Tarkett noted that while it didn’t face the same challenges as 2020, the commercial market still had its fair share of hardship to contend with. “The commercial market faced significant challenges in 2021 in terms of slow economic recovery, supply chain management and labor shortages,” explained Keesha Nickison, content manager, Tarkett. “With that said, the first quarter of 2022 has been extremely positive with strong double-digit growth across the business.”

Nickison added that workplace was initially the slowest to recover as organizations have been conservative in bringing employees back to the office full-time, but the company is seeing growth in that segment once again this year. “We believe this has a lot to do with organizations evaluating the ways the design of workspace and employee amenities will be a key driver in helping people return to the office.”

Commercial breakdown

For the commercial resilient market, LVT is the star. The resilient subcategory (including flexible click, glue-down, loose lay and rigid) accounted for 73.7%, or $1.487 billion, of the $2.018 billion commercial resilient market.

FCNews research shows flexible LVT (including glue- down, loose lay and click) accounted for the bulk of that activity with 62.1% share of the resilient commercial market’s $2.018 billion in sales and 57% of its overall volume. That’s up slightly from 61.6% in dollars and 53.6% in volume in the year prior. Of that, glue down represents 70.8% of the $1.487 billion commercial LVT market and 78% of the 798.4 million square feet.

“Glue-down is still the big driver for commercial and will remain so in the future,” Mohawk’s Ward said. “The ability to handle that heavy traffic and rolling loads and things like that are really the advantage glue-down products have on the commercial side. The only difference is in the hospitality segment where you see rigid core as a good option there. But as a rule, flex LVT is still the dominant player in commercial and we see that remaining in the future.”

Karndean’s Anderson agreed, noting the continued dominance of flexible LVT in the commercial market. “Flexible LVT (glue down and loose lay) offers much more design capabilities than rigid and has added relevance in commercial applications due to its full adherence to the subfloor and the ability to individually replace pieces, if needed.”

While glue-down is the main player in the commercial LVT market—and the commercial flooring market overall— rigid core has made some significant inroads. FCNews research shows rigid core grew 28.5% in dollar sales in 2021 to comprise 10% of the commercial resilient market’s $2.018 billion. That’s compared to 6.6% of commercial dollar sales in 2020. This growth has come mostly from within the hospitality and multi-family segments where SPC’s durability shines.

“The largest growth in the LVT product category is in the rigid core products,” Novalis’ Whipple said. “With the boom in the housing and multi-family segments, the demand for rigid core products has been almost insatiable.”

The gain in LVT’s commercial market share has come at the expense of other product categories, including VCT where its share of the commercial LVT market has dropped to 9.7% compared to 11% just last year. That’s compared to its 13.5% share of overall resilient dollars in 2019.

“LVT continues to be strong as it’s an easy substitute to carpet tiles offering a longer lasting product and so many design options,” American Biltrite’s Del Vecchio said. “We are also seeing a strong demand for LVT in the education market where they would typically use VCT. The difference in price between LVT and VCT is smaller than ever before, but LVT offers more design options and doesn’t require to be waxed.”

Commercial sheet remained on its growth track in 2021, and while it didn’t experience the same growth in dollar sales as its residential counterpart, commercial sheet saw a respectable 9.7% increase in dollar sales in 2021 to $226 million. That equated to about 11.2% share of the total $2.018 billion commercial resilient market.

“Sheet is staying strong in commercial,” Mohawk’s Ward said. “We see some potential growth in that, particularly in the healthcare segment, that’s where a sheet is the strongest in commercial due to its ability to disinfect, the ability to handle the heavy traffic and just the demand that healthcare requires. You don’t really want a lot of cracks and joints where things can get in there.”

Commercial sheet is split into heterogeneous and homogeneous constructions. Some suppliers say heterogeneous struggled in 2021. “Heterogeneous sheet is struggling to keep its market share as the visual competes with LVT,” American Biltrite’s Del Vecchio noted. “But homogeneous sheet products offer properties that are necessary in industrial and healthcare segments. We continue to see a steady, single-digit growth year over year that is here to stay, especially when we see all the construction investments in healthcare, industrial, transport, institutional and public buildings segments.”

Specifically, heterogenous comprises about 61.7% of the commercial sheet market in terms of dollars and 64.7% in terms of volume. Those percentages did not change much from 2020.

FCNews research shows linoleum’s market share remained relatively flat in 2021, garnering 5.1% of the overall resilient commercial market vs. 5% in 2020. That business is about $100 million and has been dominated by Forbo for years.

Rubber sheet and tile grew nearly 3% in dollars to $242 billion, FCNews research shows. In terms of volume, the segment saw a 6.1% increase. This can be attributed to the bounce back in projects within commercial segments in 2021 that typically specify rubber flooring. Industry sources say Nora holds what could be a 50% market share in rubber sheet and tile.

“We see a strong demand also for rubber flooring simply following an increase of projects in segments where rubber flooring is typically used such as in healthcare, the transportation industry, institutional public buildings and industrial applications,” American Biltrite’s Del Vecchio explained.

Imports vs. domestic

The resilient category is heavily positioned as an import category mainly due to its reliance on imported rigid core products. Rigid core is where the bulk of the growth is felt within the category and where sales continue to skyrocket. While some healthy product categories like sheet vinyl are made domestically, imports still far outweigh their domestic counterparts, anecdotal information shows.

In 2021, supply chain challenges and price increases influenced the relationship between imports and domestics; however, not as heavily as is predicted in 2022 and beyond. That is because while many suppliers diversified their supply chains to move product out of areas like China where tariffs and other issues have worsened, their new supplies were still impacted by exorbitant freight costs, shipping delays and raw material price increases. In addition, while several domestic and foreign resilient manufacturers announced new U.S. factories or expanded resilient capacity over the last two years, not many of these facilities have yet to come online or been able to put a dent in demand.

“2021 was definitely still import heavy,” Mohawk’s Ward said. “A lot of the [new factories] that were announced in 2019 through 2020 and even 2021 really aren’t coming online until this year. So, while there was a lot announced and a lot coming on in 2021, it really wasn’t affecting the market as much as maybe it will this year.”

Wellmade’s Quinlan agreed, noting, “There was not a significant increase in domestic supply capacity in 2021. With most domestic supply oversold in 2021, there was not much opportunity to take resilient share. With new stateside manufacturing capacity, like Wellmade’s Cartersville, Ga., plant coming online [this year], domestic production is now beginning to take market share in the resilient category.”