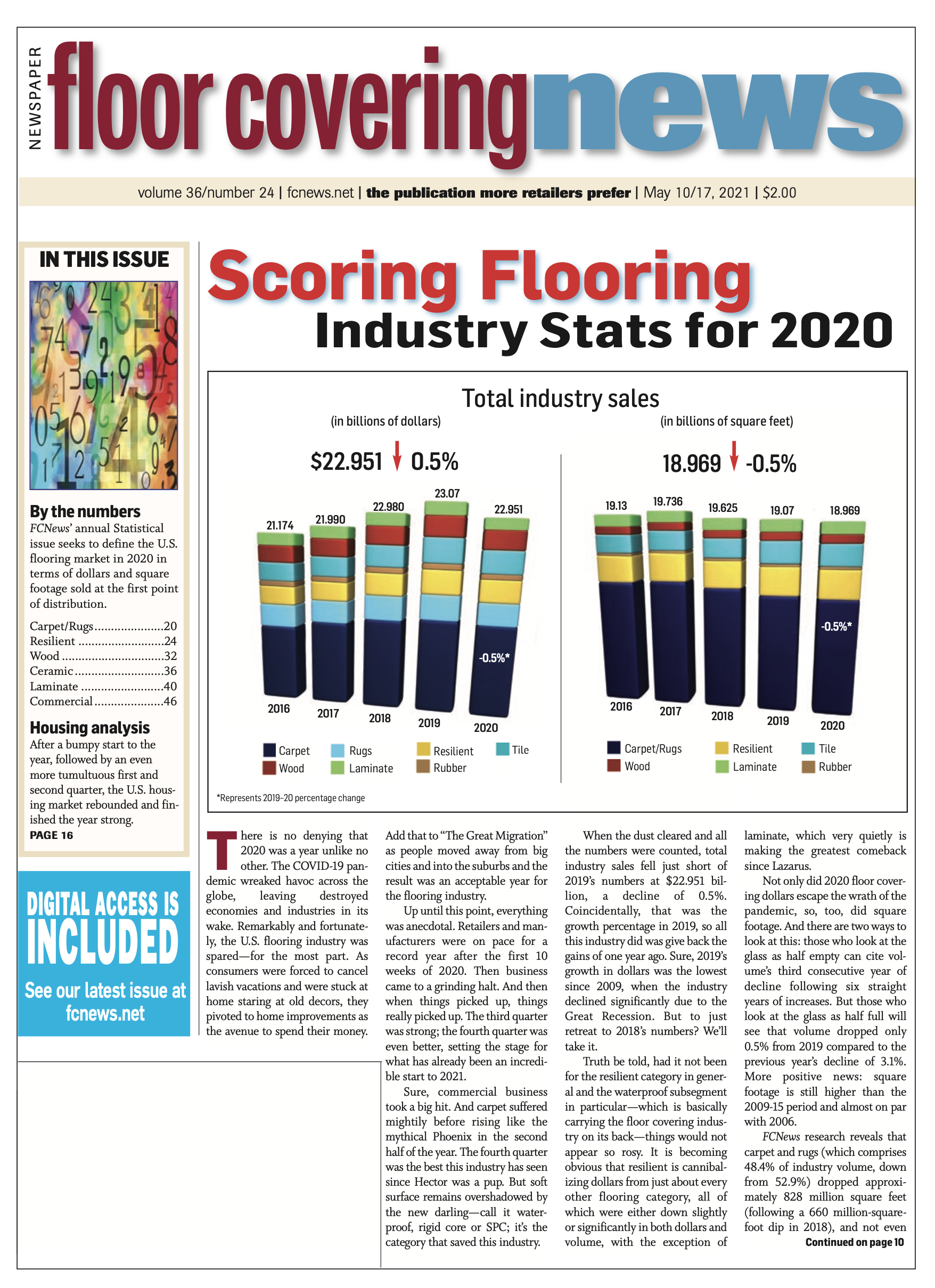

By Megan Salzano The year 2020 was a year unlike any other in recent memory and had lasting impacts on every category within the industry both residentially and commercially. Ceramic tile, which has been faced with ongoing challenges for several years now, was no exception. Continuing its downward trajectory, ceramic tile sales in 2020 experienced a low, single-digit decline in terms of overall dollar sales and similar declines in terms of volume. In comparison, ceramic tile had experienced low, single-digit growth in several consecutive years prior.

FCNews research shows ceramic tile sales in 2020 saw about a 5% decline to $2.844 billion in 2020 from $2.994 billion in the previous year. Volume also experienced a drop off, registering a 3.5% decline to 2.403 from 2.491 billion square feet in 2019.

In the grand scheme of things, the category still held strong as the third-largest sector in flooring, representing 12.4% of total industry dollars in 2020 and 12.7% of volume, down slightly from 13% of dollars and 13.11% of volume in 2019. In 2020, the category also represented 21.8% of dollar sales for the gradually increasing hard surface market and 24.6% of volume. That is down from 24.86% of dollar sales and 30.98% of volume vs. 2019.

It will come as no surprise that most ceramic tile suppliers pointed to the COVID-19 pandemic as the overarching challenge to ceramic tile sales in 2020. In fact, the first quarter even showed growth projections before initial shutdowns and uncertainty took hold. “COVID-19 was the largest impact on overall demand,” Raj Shah, president, MSI, explained. “The industry was growing by 3%-5% in [the first quarter of 2020] prior to COVID-19. In the second quarter, COVID-19 virtually turned off the industry outside of a couple of big box retailers. The third quarter started the rebound, but it was not until the fourth quarter when the industry stabilized.”

The shutdowns during the second quarter of the year—largely between March and May—had ripple effects throughout the rest of 2020. Supply issues, for example, have come to the forefront for most of the industry. The slowdown in the second quarter followed by a larger-than-expected boom in demand in the third and fourth quarters caused shipping and freight issues that have since greatly impacted supply/costs.

Another ongoing challenge for the category is that surrounding qualified labor. Tile flooring, more so than most others, requires installation by highly trained and even artisanal tradespeople. That installation can also take several days or even weeks depending on the scope and scale of the project. This pre-existing challenge was affected by the pandemic as homeowners grew wary of professional installers inside their homes—especially for extended periods.

The combination of these installation challenges could have pushed some consumers from the tile category into those that allow for easier installation or cater to the DIY community, namely resilient flooring.

Despite these hardships and a decline in ceramic tile sales in 2020, suppliers say growth is expected moving forward. The pandemic caused challenges, but it also put new opportunities in place that are ready to be tapped.

Imports vs. domestics

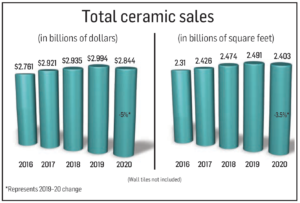

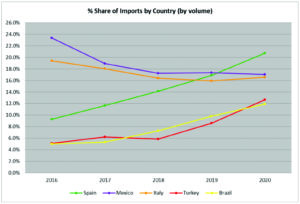

In 2020, 1.97 billion square feet of ceramic tile arrived in the U.S., down 5.3% from 2019. That marks the lowest total since 2015, according to the U.S. Department of Commerce. Imports comprised 69.3% of U.S. tile consumption by volume in 2020, down slightly from 70.6% the previous year.

In 2020, 1.97 billion square feet of ceramic tile arrived in the U.S., down 5.3% from 2019. That marks the lowest total since 2015, according to the U.S. Department of Commerce. Imports comprised 69.3% of U.S. tile consumption by volume in 2020, down slightly from 70.6% the previous year.

The coronavirus pandemic of course had an impact on imports as several countries importing tile grappled with their own shutdowns and restrictions. “While U.S. factories remained open last year, for several weeks during the spring, tile plants in the three countries exporting the most tile to the U.S. (i.e. Spain, Mexico and Italy) were shut down due to COVID-19,” explained Eric Astrachan, execute director, Tile Council of North America (TCNA). “This of course impacted exports to the U.S., and as of May 2020, U.S. imports were down 22.9% vs. May 2019. However, imports rallied in the second half of the year and ended the year down 5.3% by volume.”

The anti-dumping case also had lasting effects on imports. Early in 2020, the U.S. Commerce Department made a final determination that Chinese exporters had dumped ceramic tile in the U.S. market at less-than-fair value. The department has since imposed hefty duties on top of the current Section 301 tariffs on ceramic tile. It caused an almost total decline of Chinese imports to the U.S. in 2020, which had commanded 21.2% of total U.S. tile imports by volume in 2019 and 31.5% in 2018.

Spain has taken share and was the largest exporter to the U.S. in 2020 with a 20.7% share of U.S. imports by volume. “Obviously, there was a massive market gap left in the mid-low-end price points of ceramics with the levies against ceramic goods of [Chinese] origin,” explained Ryan Fasan, ceramic tile specialist and consultant to Tile of Spain. “The U.S. is the primary market for Spanish ceramics and the duties therefore created a huge opportunity for expanding supply to existing channels and finding new ones. The Spanish ceramics sector was well positioned to take advantage with a large percentage of market share, high perceived quality in the market and longstanding relationships with U.S. distributors.”

The next largest exporters to the U.S. were Mexico (17%) and Italy (16.6%), according to the TCNA.

On a dollar basis (including duty, freight and insurance), Italy remained the largest exporter to the U.S. in 2020, comprising 31.4% of U.S. imports, followed by Spain with a 23.4% share and Mexico with 11.2%.

The five countries from which the most tiles were imported in 2020 based on total U.S. dollar value were: Spain, Mexico, Italy, Turkey and Brazil.

U.S. shipments (less exports) last year were 871.3 million square feet, up 0.9% vs. 2019, according to U.S. Department of Commerce. The per unit value of domestic shipments (less exports) decreased from $1.55/square foot in 2019 to $1.49/square foot in 2020. U.S. shipments comprised 30.7% of total U.S. consumption by volume in 2020, up from 29.4% the previous year. That’s the highest market share recorded since 2017.

U.S. ceramic tile exports were 31 million square feet in 2020, a 2.4% decline from the preceding year. The two largest recipients of these exports were Canada (73.4%) and Mexico (10.2%), according to the U.S. Department of Commerce.

Commercial vs. residential

The commercial and residential markets had vastly different experiences in 2020. While residential sales skyrocketed in the second half of the year due to several pandemic-related shifts, the commercial market felt strain.

Commercial accounted for about 31.8% share of the ceramic tile market, or $904 million, vs. 33% in 2019. Overall, FCNews research shows ceramic’s share of the commercial market increased slightly to 14.8% in 2020, up from 13.7% in 2019.

The commercial market had its challenges within ceramic in 2020 due to the pandemic. While healthcare, hospitality and education generally post growth for ceramic, some of those sectors were hit hard with slowdowns. “Compared to new residential, commercial ended the year down in 2020,” said Paij Thorn-Brooks, vice president of marketing, Dal-Tile. “Hospitality, retail and entertainment segments suffered the most.”

However, education was a bright spot. “Our Daltile team servicing the K-12 education segment continued to work consistently on school projects throughout the pandemic,” Thorn-Brooks explained. “There was a considerable uptick in this type of work in some areas of the country due to both approved local bond initiatives and approved grants. Many school districts also took advantage of the empty schools due to the pandemic as a good time to work on their school buildings.”

Mara Villanueva-Heras, vice president marketing, Emser Tile, noted ceramic’s benefit to the commercial market. “As with the residential market, porcelain and ceramic tile are excellent options for commercial applications,” she told FCNews. “Continued focus on sustainability drives product choices. Unlike other types of flooring, the longevity of ceramic, porcelain and natural stone prevents frequent replacement and allows for easy cleaning without the use of toxic, high-VOC or harsh chemicals.”

Residential accounts for about 68.2% share of the ceramic tile market, or $1.940 billion, which saw very positive indicators around housing in 2020. Housing remains a steady meter against which to gauge the health of the ceramic tile market in the U.S., and numerous factors such as housing starts, mortgage rates and purchases were boons to the category in 2020.

Total housing starts for 2020 were 1.38 million, a 7% gain over the 1.29 total from 2019, according to a report by the U.S. Department of Housing and Urban Development and the U.S. Census Bureau. Single-family starts in 2020 totaled 991,000, up 11.7% from the previous year. The 1.34 million single-family starts pace in December 2020 was the highest since September 2006. Multifamily starts in 2020 totaled 389,000, down 3.3% from the previous year.

Existing home sales totaled 5.64 million in 2020, up 5.6% from 2019 and the highest total since the Great Recession, according to the National Association of Home Builders (NAHB).

Home purchases also saw a unique convergence of generations entering the housing market in 2020. Between the fourth quarters of 2019 and 2020, significantly larger shares of millennials (46% to 65%) and Gen Xers (43% to 57%) planning to buy a home became actively engaged and searched for a home, according to the NAHB.

“Single-family and multifamily builder sales were robust, especially considering this was within a global pandemic,” Thorn-Brooks said. “Due to the strength of remodel, we saw movement in all tile categories. Two of the places that homeowners are generally always willing to spend money in new home construction and remodeling projects are in kitchens and bathrooms, both of which are areas that heavily use tile.”

Villanueva-Heras said Emser also saw strong growth in the single-family, multifamily and builder segments. “Now more than ever, porcelain and ceramic tile are excellent options for both residential and commercial environments,” she added. “Tile offers an array of unique benefits such as durability, hypoallergenic characteristics, resistance to moisture and bacteria, easiness to maintain and clean all while offering a wide assortment of styles and colors to choose from.”

Ongoing challenges

Several challenges, many that have been in place for several years and some due to the pandemic, plagued the category and most likely contributed to a decline in ceramic tile sales in 2020. One of those challenges has been supply issues, which were felt—and continue to be tackled—by every category in the flooring industry.

“Shutdowns across the globe, starting in the spring of 2020, significantly impacted the supply of tile from both imports and U.S. producers,” Thorn-Brooks explained. “As shutdowns were eased in some countries, including the U.S., tile became more readily available. However, some major tile producing countries continue to experience multiple shutdowns, which has caused strain on the supply chain.”

Thorn-Brooks added that the trade boom that began in the third and fourth quarters of 2020 caused significant container shortages across the globe, and in particular from Southeast Asia. “This has caused a spike in container prices, which has translated into rising costs of goods being imported in the U.S. including tile, stone and other flooring.”

MSI’s Shah agreed, noting inventory reductions in 2020. “With factories domestically and foreign having their own set of COVID-19 challenges, we have seen inventory domestically significantly reduce.”

Another challenge being felt by most categories across the industry, but not new to 2020, is the continued domination of resilient flooring. The popularity and adoption of rigid core flooring—namely SPC—has grown by leaps and bounds since just 2018, and even today controls a large portion of the market. “LVT/SPC continues to take share from all flooring categories,” Shah said. “The virtues are price and total installed cost. We have to look at what does LVT not address that would provide opportunity to ceramic tile. This includes wall, outdoors, counters. All of these are billion-dollar opportunities.”

However, tile suppliers and industry experts see the tide turning for resilient—at least when it comes to ceramic. “[Emser sees] LVP as topping out in growth, although the category still has a significant portion of the flooring market,” Villanueva-Heras explained. “The category has become saturated, and pricing and margins have deteriorated. Ceramic and porcelain sales are regaining position as customers are moving toward quality, durability and sustainability.”

Tile of Spain’s Fasan said he believes consumers will soon become wary of plastic-based products, which will help tip the scale back to higher-value products like tile. “SPC, the successor to WPC, which was the successor of LVT, are frankly just attempts to put lipstick on a pig,” he said. “It’s plastic flooring. It’s cheap and looks OK if you need it to be cheap. But no three-letter acronym is going to magically make vinyl anything other than a compound of laminated, multiple petroleum-based layers with organic petroleum-based glues. I know I’m biased but, honestly, LVT only wins out when up-front cost is the principle driving decision factor.”

Fasan went on to say that he believes the decision to choose resilient over other categories like tile will be a less-common occurrence for consumers after living through the past year. “Health, hygiene and environmental impact holds a lot of mental market share for people today, and I don’t think that’s going away soon,” he explained. “The more the tile industry can make comparisons and shine a light on Another major challenge for the tile category is the shortage of qualified labor. Ceramic and porcelain tile, especially in the shapes and mosaic designs now available, requires highly skilled installers. “A significant portion of ceramic tile is professionally installed, and a lack of what you’re actually giving up—the cost-savings [with resilient flooring] start to look less attractive when the comparison is laid out in black and white.”

Another major challenge for the tile category is the shortage of qualified labor. Ceramic and porcelain tile, especially in the shapes and mosaic designs now available, requires highly skilled installers. “A significant portion of ceramic tile is professionally installed, and a lack of installers—exaggerated by COVID-19 related absences—hurt the industry,” MSI’s Shah explained.

Emser’s Villanueva-Heras said this challenge, too, is starting to see solutions come to fruition. She said many organizations, companies and schools have been addressing the labor issue and have turned to innovative ways to ease installation or identify alternatives to relieve some of the pressure and push for new growth in the segment. “An increase in demand on easy-to-install products, such as grout-less mosaics or pre-scored tiles, also provides some relief,” she said. “Long term, the solution has been labor re-entering the market and training/developing new labor. This will continue to progress and is viewed as less of an obstacle moving forward into 2021–2022.”

Daltile sought to tackle this issue head on with the early 2020 launch of its RevoTile product. “The shortage of qualified installers has affected the entire flooring market, none more so than ceramic tile,” Thorn-Brooks said. “One of Daltile’s newest innovations addresses this need. RevoTile is a patented, porcelain tile floating floor system that installs two times faster than traditional tile and installs in just three steps.”

Pandemic positives

While the pandemic caused some challenges for the flooring industry as it relates to supply and, yes, overall ceramic tile sales in 2020, it did also promote some positive changes surrounding consumer habits that are poised to support the tile category moving forward.

While the pandemic caused some challenges for the flooring industry as it relates to supply and, yes, overall ceramic tile sales in 2020, it did also promote some positive changes surrounding consumer habits that are poised to support the tile category moving forward.

For instance, the pandemic forced most consumers to shift to a home-centric lifestyle, meaning they spent much more time at home than a normal year would allow. As such, new needs were created. “The time at home provided the opportunity to remodel, especially DIY projects, and many used the federal government stimulus dollars for home remodeling,” Thorn-Brooks said.

She added that the industry has also seen growth in exterior applications as consumers spent more time at home and “have relearned the joy of spending time outside while at home and are now wanting to enhance their home outdoor experience.”

Emser’s Villanueva-Heras agreed. “Outdoor amenities and entertainment areas continue to gain popularity for dining, socializing, exercising, meditating and relaxing with an increased focus on sitting areas, fireplaces, kitchens, pools and fountains,” she explained. “Outdoor shower enclosures are also gaining popularity in warmer climates as individuals look to mimic amenities that they may have once experienced at luxury resorts in their past travels.”

The pandemic has also raised the demand for hygienic and easy-to-clean flooring products, an area where ceramic has always shined. “Tile fits into today’s ‘germ-aware’ world,” Thorn-Brooks explained. “Unlike other surfaces, correctly manufactured tile is hard and impervious, so it’s innately resistant to the growth of bacteria, mold and mildew. Tile is also a hypoallergenic surface that harbors no odor or bacteria and is also easy to clean.”

Tile of Spain’s Fasan agreed, noting the demand for tile is only getting stronger for both end users and design professionals as healthy and responsible material choices that are easy to sanitize are top of mind for all. “The multi-level impacts on perception and demand are strong for ceramics,” he explained. “As health and safety takes center stage, most people are looking at material choices a lot more critically in a holistic sense. That means ease of ownership, in terms of upkeep and sanitization as well as durability to stand up to multiple use-cases, is not just on the radar these days, it’s a vitally important deciding factor. This is all great news for ceramics as there is nothing that competes with any kind of parity to tile in addressing the prevailing chief concerns for a post-pandemic world.”

Looking ahead

While ceramic tile sales in 2020 felt the same pinch as most other flooring categories last year, tile will soldier on, and growth is expected in future. As Thorn-Brooks put it, “As trends change and other flooring types fall in and out of favor, tile has remained and will continue to remain one of the most trusted flooring solutions.”

Tile is one of the few categories that continuously pushes out truly innovative technologies and puts its full focus on unique and trending designs. The hygienic, digitally printed category remains the go-to for kitchens and baths and continues to grow its share of space in the home. “Tile product advancements are constant and evolving—from new and varying formats, to innovations in sustainability, design, patterns, textures and colors—and they will continue to drive the market in 2021,” Villanueva-Heras said. “Tile can replicate many sophisticated shapes, textures and patterns, with inspiration taken from nature, architecture, materials and fashion. These advancements have opened a whole new world of possibilities.”