The comeback that was predicted in 2020 after ceramic flooring sales experienced its first downward trajectory in several years was right on point as 2021 saw vast improvement across the board.

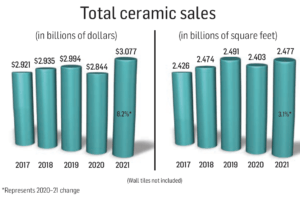

Hearkening back to the success of its heyday, the overall U.S. ceramic tile category saw high single-digit growth in 2021 compared to 2020. FCNews research shows ceramic experienced an 8.2% increase in dollar sales to $3.077 billion in 2021 (flooring only) vs. $2.844 billion in 2020. Flooring volume in 2021 was also in the black, registering 3.1% growth to 2.477 billion square feet compared to 2.403 billion square feet in 2020. That $3.077 billion is a record amount for the category, and the 2.477 billion square feet is the second highest total since 2006 when housing sales and new construction were through the roof.

Putting things in perspective, back in 2011, as the industry was climbing out of the Great Recession, ceramic tile clocked in at $1.52 billion and 1.38 billion square feet. So, in the last decade the category has doubled in value and increased 80% in volume. Along the way, average selling price increased from $1.10 to $1.24.

The category also continued to hold strong as the third-largest sector in flooring, representing 11.5% of total industry dollars—albeit down from 12.4% in 2020. In 2021, the category also represented 26.4% of dollar sales for the gradually These gains were directly linked to the strong housing market. As Andrew Whitmire, market analyst, Tile Council of North America (TCNA), explained: “2021 was a year of strong growth for both the U.S. economy and ceramic tile market. Supported by gains in the construction and housing markets, as well as historically low interest rates and falling unemployment, U.S. ceramic tile consumption increased for the first time since 2018 and was at its highest level by volume since 2006.”

(FCNews research aligns with Whitmire except as it relates to 2019. While he refers to consumption, our numbers depict first point of sale, which may not reflect distributor or end-user purchases.)

Most ceramic tile suppliers also pointed to the ongoing effects of the pandemic as having the greatest impact on tile in 2021; however, in contrast to 2020, these impacts gave the U.S. ceramic market a boost.

“People were still spending more time at home due to the lifestyle changes begun in 2020 during the pandemic,” Patrick Warren, vice president of residential sales, dealer and showrooms, Dal-Tile, told FCNews. “Many began dreaming of or executing remodeling projects in 2020 because the extreme at-home time was a daily reminder of remodeling projects they wanted to tackle. Much of that remodeling work spilled over into 2021.”

Raj Shah, president, MSI, agreed that the continuation of long-term, at-home living impacted the category in 2021. “[Work from home] remained throughout 2021, which put a huge focus on the home,” he explained. “There were few other places that discretionary funds could be used as eating out, traveling, etc., had restrictions for large portions of the year.”

Warren added that the changes brought about by the pandemic also continued to create a priority focus on specific gathering areas of the home where tile, in particular, shines. “The kitchen was still in the spotlight more than ever as the heart of the home,” he said. “Bathrooms continued to be an opportunity for a spa-like oasis retreat within the home. The pandemic also made outdoor living even more essential in consumers’ eyes as this became a greater place of entertainment and relaxation.”

Most ceramic suppliers agreed outdoor living was a boon to the ceramic business in 2021 as consumers continued to utilize every space in and around the home. “One of the premier economic drivers in 2021 was outdoor business,” Mike Weaver, vice president sales, dealer and trade segments, Emser Tile, told FCNews. “Since travel was limited, consumers turned their focused on making the most of their homes and leveraging outdoor spaces for a place of retreat and respite. Investments that would have gone toward vacations and other spending were redirected to these personal spaces.”

The pandemic also placed a new focus on cleanability, health and sanitization for consumers as they focused on upgrading or updating their homes. Tile’s inherent benefits meet these needs directly. “From the onset of the pandemic, more attention has been given to surfaces that can be quickly and repeatedly sanitized,” TCNA’s Whitmire noted. “Ceramic tile is a natural choice for such surfaces because it can be easily and quickly cleaned and holds up regardless of the cleaner. The pandemic also brought questions about the survivability of bacteria and viruses on surfaces and the efficacy of specialized antimicrobial surfaces and coatings. Interest in easily sanitized surfaces and antimicrobial testing will continue well after the urgency of the pandemic.”

Tile benefits do, however, exist beyond those that are pandemic related. Tile’s sustainable attributes and durability, for example, continue to drive its growth. “Tile offers an array of unique benefits such as durability, hypoallergenic characteristics, resistance to moisture and bacteria, easiness to maintain and clean all while offering a wide assortment of styles and colors to choose from,” Emser’s Weaver said. “Because we are able to replicate many sophisticated shapes, textures and patterns, with inspiration taken from nature, architecture, materials and fashion, tile is one of the most versatile flooring materials.”

Imports vs. domestics

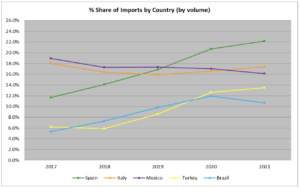

Supported by gains in the U.S. construction and housing markets and robust overall economic growth, the U.S. ceramic tile market enjoyed a strong year. Imports in 2021 reached their highest level in 15 years, according to the TCNA. The 2.23 billion square feet of tile imported last year was a 13.6% increase from 2020. Spain, which in 2020 supplanted China as the largest exporter of ceramic tile to the U.S. by volume, maintained this position. Spanish imports held a 22.2% share of total U.S. imports by volume in 2021, up from 20.7% the previous year.

Italy was the second-largest exporter to the U.S. by volume, its highest position since 2008. Italian-produced tiles made up increasing hard surface market. That is up from 21.8% in 2020 and even up from 24.86% in 2019.

On a dollar basis (CIF + duty) Italy remained the largest exporter to the U.S. making up 31.6% of 2021 U.S. imports, followed by Spain (25.3% share) and Mexico (9.8% share).

On the domestic side, U.S. manufacturers shipped 880.3 million square feet of ceramic tile domestically last year, a 1.5% increase from 2020. Though imports’ share of U.S. consumption grew from 69.4% in 2020 to 71.7% last year, domestically produced tiles’ share of consumption (28.3%) remained far ahead of all other individual countries exporting tile to the U.S., with the nearest being Spain (15.9% of U.S. tile consumption), Italy (12.5%) and Mexico (11.5%).

17.4% of the U.S. import market last year, up from 16.6% the previous year. Mexico, which was the third-largest exporter to the U.S., has seen its share of total imports fall steadily over the last decade from an all-time high of 31.5% in 2012 to 16.1% last year. Rounding out the top five were Turkey (13.5% share) and Brazil with a 10.7% share of U.S. imports by volume.

In dollars, 2021 U.S. FOB factory sales of domestic shipments were $1.36 billion, a 5% increase from 2020, according to the TCNA. U.S. shipments comprised 35.2% of 2021 total U.S. tile consumption by value, down from 39.3% the previous year. The per-unit value of domestic shipments increased from $1.49/square foot in 2020 to $1.54 last year.

U.S. ceramic tile exports in 2021 were 38 million square feet, a 22.5% increase from the previous year. The two largest consumers of U.S. exports by volume were Canada (70.7%) and Mexico (14.3%). The value of U.S. exports rose 29.8% from $31.2 million in 2020 to $40.4 million last year.

Despite U.S. imports of tile reaching their highest levels in 15 years, the category nonetheless felt the impact of a strained supply chain. “In 2021, the supply chain was extremely difficult and had a large impact on the ceramic category,” MSI’s Shah told FCNews. “Approximately 65% of ceramic tile is imported. Lack of ocean freight options, large increases in ocean freight pricing as well as domestic issues—including trucking and raw material shortages—wreaked havoc on the industry.”

Commercial vs. residential

Just like 2020, the commercial and residential markets had vastly different experiences in 2021. Residential sales skyrocketed due to several ongoing pandemic-related shifts, while the commercial market continued to feel the strain. However, both segments of the market experienced growth last year.

Commercial represented about 34% share of the ceramic tile market, or $924 million of the $3.077 billion market—that’s a 2.2% increase in 2021 over 2020. Overall, FCNews research shows ceramic’s share of the total commercial market decreased slightly to 14.2% in 2021 vs. 14.8% in 2020.

“The commercial market in 2021 was relatively flat and clearly with rates well below the growth of residential,” Greg Mather, president, Crossville, told FCNews. “Early in the year there was little investment in the office and hospitality segments in particular. The good news is that as the year progressed, the A&D design activity increased across segments and this started to result in growth later in the year, which is expected to continue into 2022. Education and healthcare were healthy in 2021. Hospitality improved through the year as travel and entertainment activities increased.”

Kent Claussen, vice president sales, commercial, Emser Tile, agreed, noting that project activity at A&D and with end users picked up in the fourth quarter and accelerated into 2022. “The next two years will be strong for the commercial segment,” he said.

Claussen added that in 2021 multi-family grew at the strongest pace driven by the demand for housing. “Although multi-family is more of residential end use, the specification and performance requirements make it more of a combined commercial/residential segment.”

In terms of traditional commercial segments, Claussen noted that hospitality bounced back in 2021 but was still significantly off its pre-pandemic levels. “Growth drivers within hospitality were rehab projects and delayed hotels coming back online,” he noted.

Claussen added that education and healthcare grew in the range of 5%-7%. “The driving force for education was aging infrastructure and new construction to support geographical growth. Healthcare was impacted by some of the same factors in addition to the aging population requirements. Retail and restaurant recovered at a slow pace in 2021 and again was off pre-pandemic levels.”

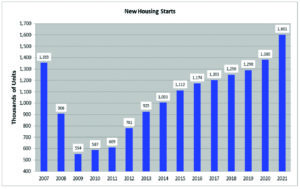

The residential side of the business saw an 11% increase in sales to $2.153 billion of the $3.077 total ceramic market. Housing remains a steady meter against which to gauge the health of the ceramic tile market in the U.S., and numerous factors within the housing market were boons to the category in 2021.

Despite supply chain and labor issues, new home starts rose for the 12th consecutive year and were at their highest point since 2006, according to the TCNA. The 1.6 million units started in 2021 represented a 16% increase from the previous year. With record-high average new home prices and a low supply of available properties, new single-family home sales fell for the first time in a decade. The 770,000 units sold in 2021 represented a 6.3% decline from the previous year, according to the U.S. Census bureau.

“In 2021, the United States experienced one of the strongest housing markets in history, with low mortgage rates enabling people to afford a new home more than ever,” Dal-Tile’s Warren said. “Those who were not moving were remodeling. Both builder and residential redesign had a robust year. Due to the strength of remodel, we saw strong movement in all categories, especially wall tile mosaics and countertops. It is important to note that two of the places where homeowners are generally always willing to spend money in new home construction and remodeling projects are in kitchens and bathrooms, both of which are areas that heavily use tile, so this was good news for the tile industry.”

Emser’s Weaver noted that custom homebuilding was at an all-time high in 2021—another boon for tile. “We experienced extreme growth due to a robust economy and demand for housing. We also saw significant movement in renovations as people were house hunting and moving at record rates. A robust economy and housing market boom, both interior and exterior, has fed our growth. Some could not afford to make a move, but instead opted to invest in their current spaces seeking more comfort and equity in their existing homes.”

Crossville’s Mather agreed that the factors driving increased residential business included new homebuilding increasing by double digits vs. 2020 and strong remodel activity. “The remodel activity was up mid-high single digits according to the Joint Center for Housing Studies through Harvard University. This is driven by homeowners continuing to spend more money updating their homes as they spend more time at home vs. pre-pandemic. It provided a foundation for strong growth in 2021.”

Ongoing challenges

While the ceramic category saw growth across the board, it is not without its challenges. In fact, MSI’s Shah noted that much of the growth experienced in 2021 was due to price increases rather than pure volume-driven growth.

“Similar to the supply chain challenges, installation and lack of manpower hurt the industry,” Shah added. “This caused severe inflation in installation costs but also lead times for installations lengthened significantly.”

Dal-Tile’s Warren agreed, noting, “Inflation continued to be a headwind as prices rose at unprecedented rates, which put pressure on the whole construction cycle from manufacturing to installation. We were working around the clock in 2021 to bring down costs and maximize productivity to minimize the burden on our customers.”

Indeed, one major challenge that hits the ceramic category particularly hard is the lack of qualified installers entering the industry. “The shortage of qualified installers is a critical issue for the entire flooring industry,” Emser’s Weaver noted. “It impacts the quality of installs and leads to higher claims and consumer dissatisfaction. We are addressing this by supporting industry organizations that provide training and offer expertise to our sales team and branches. Also, we provide complete installation systems at our branches, including setting materials, clips and wedges and our Signature series trims. The availability of these items along with our local expertise helps versus big box alternatives.”

At Dal-Tile, Warren said the company continues to partner with all trade associations on developing training/career programs to educate on the benefits of being an installer. “For example, the Floor Covering Education Foundation (FCEF) is a great way to bring together those seeking tremendous career opportunity and an industry looking for talented, motivated individuals,” he said.

As ceramic continues to face challenges, flooring categories like WPC/SPC continue to nip at its heels. The category has lost share to the growing temptations of the resilient rigid core category and that trend is likely to continue with ceramic’s high cost of entry and immense labor charges/challenges. “Rigid core and vinyl-based products took share as end users looked to lower costs and speed installations,” Emser’s Weaver said.

For MSI’s Shah, the trend isn’t as detrimental as it may seem—the two flooring materials can (and should) work together. “I believe that the two materials can live together and thrive together,” he stated. “There are many places that rigid core cannot be used that ceramic can be used. In addition, there are many aesthetics that ceramic can provide that rigid core cannot provide. It is imperative that ceramic tile manufacturers continue to innovate both aesthetics and uses for ceramic tile. This innovation will ensure the industry continues to grow. Ultimately, it would seem that carpet is at the bigger risk of degradation from rigid core and ceramic.”

Looking ahead

As the residential market continues to boom and the commercial side of the business recuperates, ceramic tile suppliers are optimistic about the category’s future.

“[Commercial] growth YTD in 2022 has been strong,” Crossville’s Mather said. “A&D activity as well as projects across virtually all segments have increased.”

Residential suppliers are also confident. “Despite hurdles, the tile industry should have a stable year in 2022 with both new and residential remodel continuing to grow while commercial should continue with momentum that began on the back end of 2021,” Dal-Tile’s Warren said.

Emser’s Weaver added, “This is a great year so far with success being driven by directing our attention on the end user. Identifying what is important to our customer has been our focus. The biggest challenge remains the supply chain, and transportation challenges remain the biggest impact on the market.”

Importers, too, are keeping an eye on the horizon as challenges remain. “It is early in 2022 and the main news around ceramic is inflation,” MSI’s Shah said. “The Russia/Ukraine war has put significant cost pressures on ceramic tile. This includes natural gas and raw materials pricing skyrocketing for ceramic tile, especially as it relates to tile from Europe. In addition, ocean freight rates continue to rise adding even more cost pressures to ceramic tile.”