Changing the rules. That’s what industry disrupters are doing when they innovate to the point that it shifts the traditional paradigm. In flooring, it can be as explosive as developing completely new product formulations that offer consumers features/benefits not previously available—we’re looking at you, WPC. Or it can be as simple as stripping down complexity to give consumers a more intuitive experience—something software/tech firms are getting rather good at. Disruption can also occur within the industry from causes outside of it.

This year’s Floor Covering News “Industry Disrupters” 2024 issue features all manner of players that are—or are poised to—shake things up.

Geopolitical issue

Geopolitical issue

The annals of history are rife with episodes of upheaval that have significantly impacted the course of human history. Such is the case with recent events like the Israeli/Hamas War as well as the lingering conflict between Russia and Ukraine. And as we’ve seen so many times before, what often begins as regional conflicts eventually infiltrate the world at large, including global economies as well as countries closest to the source of the conflicts.

Take, for example, the Ukraine-Russia war, which has had significant ramifications on the global economy, affecting various sectors and regions around the world. One of the most immediate impacts of Russia’s invasion of Ukraine—which entered its second anniversary—has been on energy markets. Russia is a major exporter of natural gas to Europe, and the war has raised concerns about the stability of these supplies. As tensions escalated, energy prices soared, leading to increased costs for consumers and businesses worldwide. This volatility in energy markets has also contributed to broader uncertainty.

The Ukraine-Russia war has also disrupted global supply chains. Ukraine is a major exporter of agricultural commodities such as wheat and corn, and the conflict has disrupted production and export capabilities. This has led to supply shortages and price spikes in global food markets, impacting both consumers and producers.

Conversely, the Ukraine-Russia war has affected exports of Russian birch, a key material used in engineered hardwood flooring. Russia is a major supplier of birch wood to global markets, particularly to countries in Europe and Asia.

While hardwood flooring suppliers around the world have since secured alternative sources for the core material utilized in many engineered hardwood flooring products, there’s no disputing the fact that the disruption in the supply of Russian birch has led to shortages and price increases in the global market for engineered hardwood flooring.

Israeli/Hamas war

In much the same way that the Ukraine-Russia conflict has resulted in the loss of life and caused uncertainty on the global stage, Hamas’ invasion of Israel on Oct. 7 last year has also resulted in massive human casualties while also disrupting commerce in international waters.

The conflict between Israel and Hamas, while primarily localized to the Gaza Strip and surrounding areas, is intertwined with broader regional dynamics, including the actions of groups like the Houthis, a Yemen-based insurgent group with ties to Iran. The disruption of shipping routes by the Houthis, particularly in the Red Sea and the Bab el-Mandeb strait, has significant implications for regional and global trade. These routes are vital for the transportation of oil, natural gas and other commodities, making them strategic choke points. The Houthis have targeted commercial vessels and infrastructure, including Saudi oil facilities, in an attempt to disrupt the operations of their adversaries and assert their influence. The instability caused by the Houthis’ actions exacerbates existing tensions in the region.

Engineered Floors

Engineered Floors

For most of its first 10 years Engineered Floors focused on the carpet segment, staking out a leadership position with PureColor solution-dyed polyester. Engineered Floors is aiming to make a similar impact on the hard surface side with PureGrain HiGH-DEF digital printed/embossed SPC.

PureGrain direct digital print DLVT flooring uses digital embossing technology to create high-definition designs directly on a high-density rigid core. These products offer the realistic look and feel of actual wood. PureGrain is said to offer greater color clarity (5x more compared to traditional film products, the company said), embossed texture dimension, enhanced abrasion properties and is designed with 35 unique planks.

This is all happening in the U.S.—a first-of-its-kind approach. Some may mention that while EF may be the first, it might not be the last. Nonetheless, EF has shaken up the status quo with it’s Made in the USA digital printing and embossing initiative.

Broadlume

Broadlume

Broadlume’s Digital Retailing initiative aims to reinvent the shopping experience for the consumer while creating a more fluid selling strategy for the retailer. What’s more, the initiative is designed to change how retailers and manufacturers work together to sell that flooring.

In a nutshell, this is technology that enables shoppers to complete most of the transaction online—learn about products, visualize, order samples—and, eventually, buy in-store at their local dealer. The technology also includes an intuitive lead-generation system that delivers leads from every digital interaction.

It’s a new approach to retailing that is quickly gaining traction among manufacturers (and retailers) and is poised to reshape the shopping experience.

Merchandising: Showroom within a showroom

Merchandising: Showroom within a showroom

In recent years there has been a renewed focus on innovative merchandising systems designed to elevate the shopping experience for the consumer and selling experience for the RSA. This “showroom-within-a-showroom” concept is positioned as next-gen merchandising.

Shaw, for example, partnered with Nebraska Furniture Mart to launch the Anso Gallery. The novel showroom-within-a-showroom concept is the byproduct of a nearly year-and-half-long collaboration to create an elevated, in-store carpet buying experience. The high-impact destination, which occupies roughly half of the space dedicated to carpet at the flagship NFM store, features Shaw Pet Perfect carpets made with Anso high-performance fibers.

Daltile is another brand that crafted a new merchandising system for its Statements Elite dealers, a showroom-within-a-showroom experience dubbed Statements 2.0. The concept serves as a destination within a store and is designed to increase profitability for dealers and simplify the shopping experience for consumers. Statements 2.0 is also designed to connect the customer’s online experience to in-store, providing an integrated experience.

Then there’s the Riva Corner & Gallery program, an avant-garde concept of high-end showrooms designed to provide consumers with a luxury buying experience. The showroom features full size plank samples and access to marketing and design services.

Shoddy SPC

Shoddy SPC

For years, the meteoric rise of SPC flooring seemed unstoppable. The segment posted astronomical gains year over year, beating out every other flooring category in terms of growth and stole share from carpet, hardwood, ceramic and laminate.

However, with great power comes great responsibility—a position many “me-too” suppliers failed to uphold, and the category saw an influx of product that didn’t meet high quality, performance and/or environmental standards.

The proliferation of this shoddy SPC impacted the industry in several ways. For one, it pushed many SPC suppliers to elevate their game and introduce highly stylized and performance-laden product lines that have since elevated the category.

Cheap SPC has also led to the resurgence of a flooring category that had not seen such interest since the 90s: laminate. The category has generated renewed interest in the last year as a result, in part, of the many issues shoddy SPC have raised. Many suppliers of SPC have recently entered the laminate category, which now touts many of the performance attributes that made SPC such a highly sought-after product. That growth is only expected to continue.

Private equity influence

Private equity influence

The flooring industry has seen a marked increase in the flow of private equity money into businesses in recent years. Why the interest in flooring? Experts say it’s because private equity firms look to invest in stable industries with relatively good margins or underappreciated assets. Flooring entities check one or more of those boxes.

Specifically, distribution has been a target of private equity for some time, with several top 20 wholesalers receiving investments. A series of distributor acquisitions culminating with the 2022 purchases of Blakely Products and All Tile and Carpet Cushions & Supplies (All Tile CCS) created All Surfaces—which formerly operated as Crown Products, a private equity firm. It now ranks as the No. 2 distributor.

Other top 10 distributors including top 4 Galleher and No. 6. E.J. Welch, which were sold to private equity firms as well. Industry observers say wholesalers are prime targets because many are family businesses and may not have a succession plan or don’t have the resources to scale.

Meanwhile, a number of mid-sized flooring suppliers, among them CFL and Stanton, have been infused with private equity.

On the retail side, 31st Street Capital, a family-owned holding company that was founded in October 2018, has already acquired six flooring retailers—the last being Sam Kinnaird Flooring last year. The company said it plans to make a flooring retail acquisition each year for the next several years.

Cyncly

Cyncly

The last several years has seen an influx of software and digital marketing solutions enter the industry. Recently, there have been some entities gobbling up individual solution providers to create fully integrated solutions specifically geared toward the flooring retail community. Cyncly, for example, a global market leader for end-to-end software and content solutions, entered the flooring industry in 2022 with the acquisition of RFMS, a business management software provider focused on the flooring industry. The following year, Cyncly expanded its footprint again with the acquisition of Pacific Solutions, one of the leading commercial flooring business management software providers in North America. Just a few short months later, Cyncly announced the purchase of one of the industry’s top firms in its field: Mobile Marketing.

While the pros and cons of this kind of consolidation continue to be weighed, the acquisitions are geared toward enhancing Cyncly’s ability to deliver an integrated solution across the customer journey.

Mohawk

Mohawk

There’s no doubt that the U.S. laminate flooring market is currently undergoing a resurgence—and it’s also clear that products like Mohawk’s vaunted RevWood line is driving much of that sales activity.

Launched roughly six years ago, RevWood—built on a traditional laminate fiberboard chassis but enhanced with advanced visual, textural and performance technologies—continues to evolve and lead the category. With every successive iteration, the product continues to more closely emulate the genuine wood article, both in terms of visual depth as well as heft of real wood. Some might even go as far as saying that RevWood brought excitement back to a category that, up until a few short years ago, was associated with entry-level, value-driven flooring found mostly in home centers. Not anymore. The company’s top-selling laminate offering has inspired other manufacturers in the category to not only improve on traditional laminate flooring technologies, but also develop products that specialty retailers can sell at much higher profit margins.

The latest enhancement to RevWood includes the application of Mohawk’s proprietary Signature Technology, a sophisticated image capturing innovation that collects scores of minute details of wood plank scans and then renders those characteristics in incredible detail on the design layer of the product. RevWood also boasts Mohawk’s WetProtect technology, which increases the product’s resistance to moisture incursion.

Presidential election woes

Presidential election woes

In past presidential election years, the economic landscape typically undergoes a subtle yet palpable transformation, influenced by uncertainties surrounding policies and leadership changes. By and large, consumers generally take a cautious stance toward spending, wary of potential shifts in taxation, regulations and economic stability.

Statistics reflect this sentiment: U.S. retail sales often experience a noticeable dip during election years, as consumers curtail discretionary spending. According to data from the U.S. Census Bureau, retail sales growth tends to slow down in the months leading up to a presidential election compared to non-election years. Consumer confidence, a key indicator of economic health, tends to fluctuate during election cycles. The Conference Board’s Consumer Confidence Index often shows a decline in confidence levels as election day approaches, reflecting concerns about the future direction of the economy under new leadership—particularly in the current economic climate in which we find ourselves.

But it’s not just consumers that are affected. Businesses, too, exhibit a reluctance to invest in expansion or capital projects in the face of economic uncertainty or trepidation of the unknown. Corporate investment tends to stagnate as companies adopt a wait-and-see approach to assess the impact of potential policy changes on their bottom line. As a result, investment in new ventures or projects may be delayed as companies assess the potential risks and rewards associated with the outcomes of the election.

INA distribution consortium

INA distribution consortium

In the annals of flooring distribution there has never been a single national distributor servicing the U.S. Some have tried. Back in the day, LD Brinkman and Hoboken both made attempts, but ultimately failed.

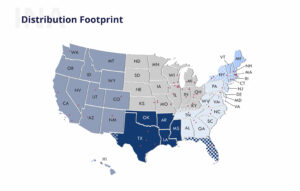

Today, however, the industry has the closest thing to national distribution in INA, short for Interiors North America, a consortium of the three largest flooring distributors—Belknap-Haines (including its STC division, formerly Swiff-Train); All Surfaces (including All Tile CSS); and Tri-West Ltd.

INA collectively generates roughly $1.5 billion in revenue annually and operates a footprint that essentially covers the entire U.S., including Hawaii.

Belknap-Haines, the No. 1 distributor with revenue of $700 million, encompasses the entire East Coast from Maine to Florida as well as Ohio, Indiana and Kentucky. STC (formerly Swiff-Train, which was originally part of INA) services Texas, Oklahoma, Louisiana, Colorado, Arkansas, Mississippi and Florida, and has several distribution facilities located throughout Texas.

Minneapolis-based All Surfaces, the No. 2 distributor at $420 million, is made up of five distributor brands and boasts 50 distribution locations across 16 states with a fleet of 100 trucks connecting all locations to its major distribution centers in the Midwest and upper Midwest.

No. 3, Tri-West ($350 million), has a territory overseeing more than one-third of the U.S., mostly on the West Coast (nine states including Hawaii) and as far east as Colorado.

INA stocks products at 72 locations coast-to-coast, maintaining millions of square feet of capacity, with hundreds of trucks delivering flooring products daily to retailers nationally, with specific programs and products offered.

Industry-wide term changes

Industry-wide term changes

Many flooring retailers were up in arms last year when some major suppliers announced they were changing payment terms and eliminating discounts.

The manufacturers informed the dealers that they were moving to standard payment terms of net 30 days for all products. For suppliers the move was intended to bring all flooring products in line with other building materials and home renovation product segments. In addition, the suppliers dropped discount terms for early payment on many of its products.

Historically, hard surface flooring has always been sold on net 30 terms, and this change removed the complexity of offering different terms for carpet vs. all other flooring materials.

Since that announcement, mills have stuck their ground, keeping terms in place. Dealers handled it in different ways. Some raised prices to make up for the difference; others tried to cut their own deal with the suppliers or simply took the hit and moved on. Either way, disruption was evident and continues to this day.

UFLPA

UFLPA

Not all disrupters are good for the flooring industry. The Uyghur Forced Labor Prevention Act, better known as UFLPA, became a no-win situation for suppliers once U.S. Customs and Border Protection added PVC as a “sector of concern” when inspecting shipments from China.

The burden of proof on suppliers became so onerous that most simply gave up on sourcing from that region and pivoted to other countries. “Once you get detained, the burden of proof is so high that you’ll never be able to get your goods cleared,” David Sheehan, senior vice president, residential product for Mannington, said at the time.

If anything positive emerged from UFLPA it’s that it taught companies the importance of a diversified supply chain. Today, LVP suppliers are less reliant on China and more inclined to look to Vietnam, Cambodia, Thailand, India and even Mexico for their sourcing needs.

The UFLPA situation also accelerated the non-PVC product movement, industry observers say.

Roomvo

Roomvo

Roomvo burst onto the scene a handful of years ago and helped to reshape the consumer shopping experience as well as ease the selling process for RSAs. Not only does Roomvo offer the most advanced visualizer in the industry, but it helped drag the flooring industry into the 21st century with digital tools it was severely lacking. Throughout the years, Roomvo has grown to include partnerships with manufacturers and buying groups as well as new website technologies, all designed to update conventional—a.k.a outdated—buying/selling habits. Roomvo is now live in 5k retail showrooms daily, featuring over 1 billion products.

PVC-free resilient flooring

PVC-free resilient flooring

Resilient flooring—namely the rigid core subsegment—has been on a wild ride. It burst onto the scene over 10 years ago and has since evolved into several new iterations that have each enthralled consumers, buoying it to the faster growing and highest grossing product in flooring. This year, a new iteration of rigid core flooring was launched by various suppliers with the potential to disrupt the category again: PVC-free/recyclable rigid core.

It’s no secret that SPC has had its fair share of hardship over the last few years. Tariffs, U.S. Customs detentions and even shoddy workmanship have turned off many who were heavily invested in the category. What’s more, consumers have once again become concerned over the use of plastic and plastic waste, which continues to negatively impact the planet. To help assuage this concern, many suppliers have developed PVC-free and recyclable product lines that still tout all the performance and design benefits SPC is known for. Some of those companies include: Mohawk with its newly launched PureTech line; AHF with its Ingenious Plank; Nox, which touts its Circular IVP system, allowing for all of its products to be recyclable; Benchwick’s Blue 11, which is made with post-consumer waste; Raskin, which recently launched its PVC-free and recyclable Stone + Wood line; and Eva-Last, which provides PVC-free and recycled product via its Tier brand, to name a few.

Inflation

Inflation

In recent years, consumers and business owners alike have gotten a crash course in inflation—loosely defined as a “general increase in prices combined with a fall in the purchasing value of money.”

Inflation impacts virtually every aspect of life—from the price of eggs and bacon at the supermarket, to the percentage consumers pay for bank loans, to the mortgage rate secured on a home purchase. It’s that last point in particular that has impacted the flooring industry the most, given the sector’s dependence on the health of both new home construction as well as home resales.

Inflation typically leads to higher construction costs due to increased prices of raw materials, labor and transportation. This can raise the cost of building new homes, leading to a decrease in housing supply and higher home prices.

Second, inflation can influence mortgage rates. Central banks often respond to inflationary pressures by raising interest rates to curb spending. However, higher interest rates increase the cost of borrowing for homebuyers, further dampening demand for housing and pricing out many potential buyers. Conversely, during periods of low inflation, central banks may keep interest rates low to stimulate economic activity.

Now all eyes are fixed on the Federal Reserve in anticipation of interest rate drops later in the year. After holding rates steady for the better part of the past four quarters, economists are banking on rate drops now that inflation has fallen from nearly 9% in 2021 to about 3.2% as of March 12.