Flooring dealers remain enthusiastic that business activity will continue to grow heading into the summer season overcoming a slew of economic headwinds. In fact, the consensus among several of the industry’s bellwether retailers is that while foot traffic has slowed since April—and inflationary pressures have heightened—the spending power of consumers is still winning the day.

“Traffic has definitely slowed down; however, the customers that are coming in are buying and we are continuing to see a rise in the average ticket size,” said Ted Gregerson, CEO, Abbey Carpet & Floors/Floors To Go, Anniston, Ala. Gregerson’s comments were more the norm than the exception.

As Cathy Buchanan, co-owner of Independent Carpet One Floor & Home, Westland, Mich., noted, “Even though traffic is down, the average ticket is larger. Renovations of houses is a trend we are seeing, and commercial work seems to be making a resurgence.”

The key takeaway is that while business has abated from the record-setting levels of 2021, we’re not in a perceived slowdown or recession. In some cases, business is still booming. “We are incredibly busy in all facets of our business right now—builder, retail and commercial,” said Deb DeGraaf, co-owner, DeGraaf Interiors, with three Michigan locations. “We have really ramped up our focus on service and customer experience, and I believe that has helped our overall volume. We are seeing double-digit growth through the first quarter in all three segments and all indicators are this will continue through this summer and end of 2022.”

For Denver-based Carpet Exchange, the average ticket is up 14% over 2021, which was a record year for Bruce Odette’s business. “We are most recently seeing order entry flat against record numbers last year,” he said. “That being said, the delivered business is still well above prior year. Some of the gains this year are coming from inflationary dollars, not increased unit sales.”

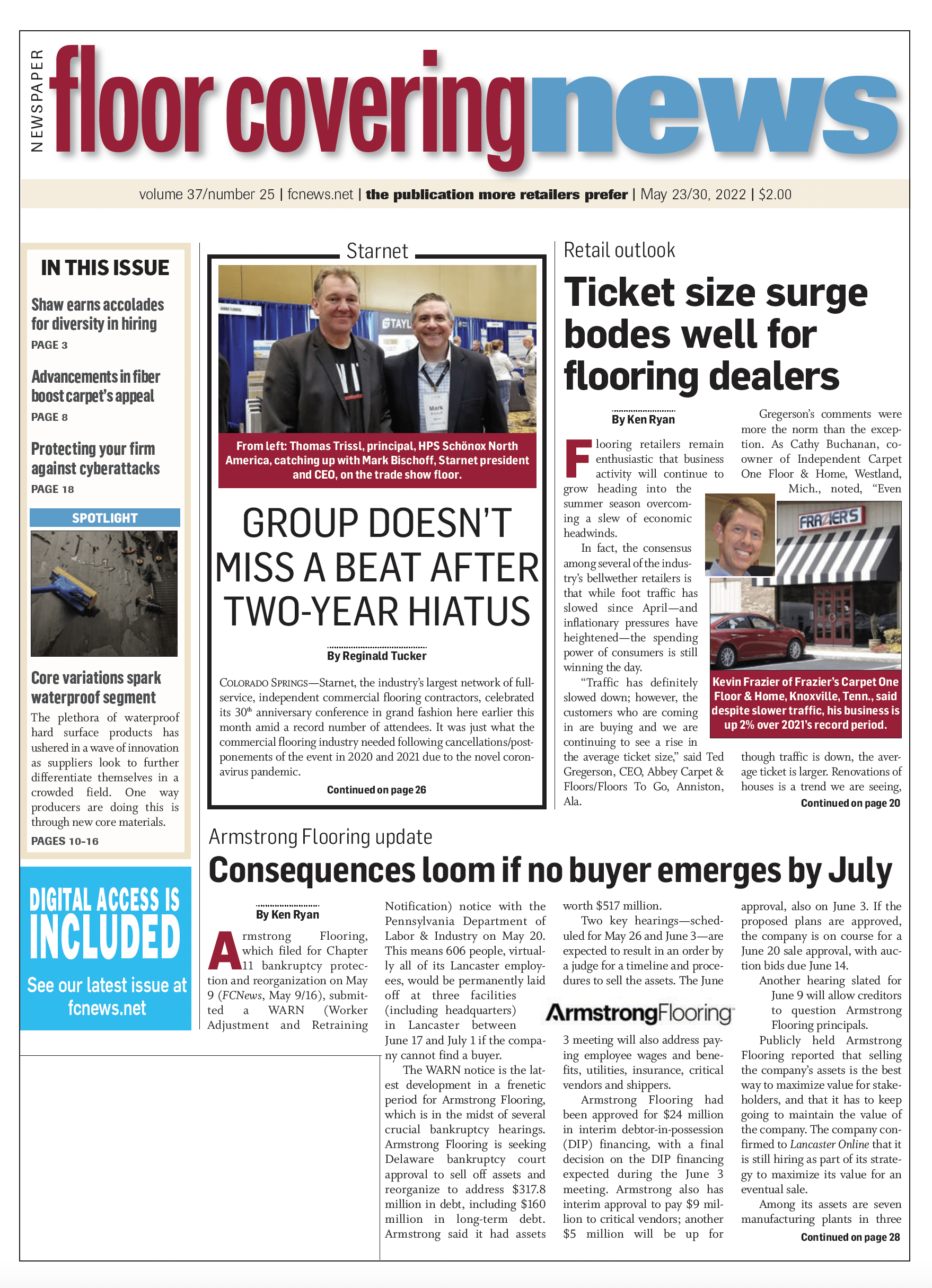

Business remains buoyant for Knoxville, Tenn.-based Frazier Carpet One Floor & Home, which year-to-date is up 2% over its record 2021. “Here in the Southeast, the home improvement and housing market both remain very hot,” said Kevin Frazier, president. However, even in a strong Southeast market, Frazier said he is experiencing periodic dips in traffic resulting in slightly softer demand compared with the previous six months.

That’s a trend playing out in other markets as well. “Foot traffic has slowed down a little but there are still a lot of larger projects in the works,” said Don Cantor, owner of Lake Interiors Chelan, in Chelan, Wash.

The pace has slowed in San Antonio, too, where Sam O’Krent, president of O’Krent Floors, reported traffic counts have ticked down since the middle of April. Not that he is complaining. “In a strange way, the slowdown has been nice, allowing us to catch our breath and get back to planning. The past two years have been so strong that it was just a matter of survival to keep up. We’re still tracking 10% over our 2019 numbers, which is the last realistic year for comparisons.”

Economic worries

As is the case for every small business, flooring dealers are obviously concerned with the out-of-control inflation and recent stock market losses, fearing that it will have a psychological effect on consumers and curtail their spending. In Michigan, for example, rising fuel prices and ongoing supply chain disruptions that exacerbated computer chip shortages for automobiles has resulted in layoffs and hurt consumer confidence.

“To be a retailer is more challenging than ever before and not only due to slower business trends but with trying to maintain profit margins despite the constant price increases whether for material or freight reasons,” Buchanan said. “Business has flattened and will continue to follow this trend, I believe, for the remainder of at least the summer months.”

Outlook

Several flooring dealers said they are expecting a cautious summer of consumer spending due to inflationary fears.

Lake Chelan’s Cantor said he keeps in touch with leaders in his network—contractors, developers, bankers, realtors, appraisers and home inspectors—to get their take on expectations for his area. “Most of them are starting to see a little slowdown due to inflation of building materials and product availability,” Lake Interiors’ Cantor said. “A few of the contractors have said that their customers have put a hold on building.”

Others are expecting similar conditions. Saying she doesn’t see a future upswing, Independent’s Buchanan observed, “Building is shrinking due to availability of not only building materials but windows, appliances, sinks, etc. Hopefully, though, the higher-ticket item trend will continue.”

Frazier, a fellow Carpet One retailer, is still expecting a record 2022, projecting 2%-4% growth over last year’s high-water mark. “We are focused on excellence in execution—to stand out from the crowd,” he said. “I’m seeing evidence of consumer frustration out there across all industries, with poor, unresponsive service. The bar for customer service has been so significantly lowered as to make it very easy for full-service providers like us to stand out.”

When business conditions soften, Abbey’s Gregerson does what a lot of successful retailers do: they stay aggressive. “We will continue to spend on marketing and advertising, which we have always found to benefit us even in slower times,” he said.

Going into the summer months, Carpet Exchange’s Odette said he is “highly optimistic” that his business can maintain its record pace.