By Reginald Tucker

Despite the hit the U.S. economy has taken as a result of the government-mandated COVID-19 lockdowns, there are signs conditions are improving. That’s according to the June 2020 Trends Report released by ITR Economics, the firm known for its spot-on economic forecasts and predictions.

While there is no denying many aspects of the U.S. economy have been hard hit—especially small businesses—the economy is beginning to move closer to a recovery, according to the report.

“A minority of businesses have prospered because of COVID-19—or in spite of it,” said Brian Beaulieu, CEO and chief economist. “Our update, based on economic trends, the COVID-19 trends and governmental decisions, suggest we are on track for a second quarter 2020 low in GDP—and that GDP will begin to slowly improve in the third quarter and improve further in the fourth quarter barring governmental action (disease or civil unrest related) that causes large parts of the economy to shut back down. We continue to think the adverse governmental action is not probable—we are on track for the projected recovery trend.”

Leading indicators point to improving conditions

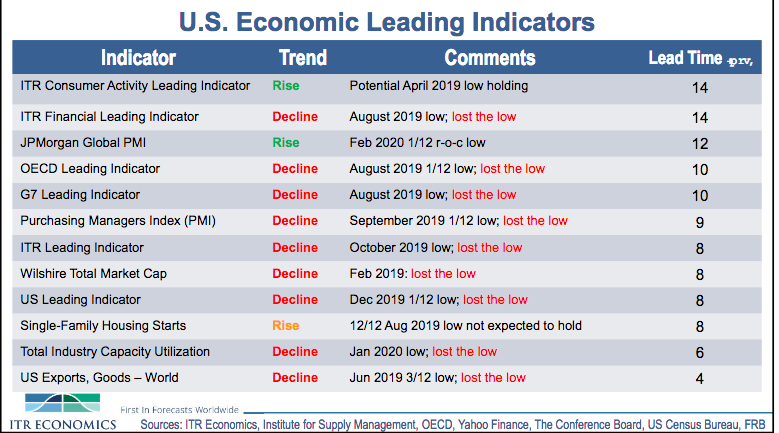

ITR Economics typically bases its economic forecasts, predictions and outlooks on key leading indicators. These are as follows:

- JP Morgan Global Manufacturing Purchasing Managers Index

- U.S. ISM Purchasing Index

- ITR Retail Sales Leading Indicator

- ITR Final Leading Indicator

- ITR Leading Indicator

- Wilshire Total Market Cap

- OECD Leading Indicator

- G7 Leading Indicator

- U.S. Leading Indicator

- Single-family housing starts

- Total industry capacity utilization

ITR Economics’ leading indicator system requires five leading indicators heading in the same direction to provide statistical confidence that a shift in the economy is looming, whether that is a shift to a rising trend or a shift into decline. At present, four of those leading indicators are signaling a turn for the better: J P Morgan PMI, U.S. ISM Managers Index, ITR Financial Leading Indicator and Wilshire Total Market Cap.

“We have been looking for early signs of the recession reversing direction and the eventual general economic recovery ever since nearly all the leading indicators on our dashboard flipped from green (rise ahead) to red (decline ahead),” Beaulieu explained. “We have stated in prior months that it would be normal to see some indicators that reverted to negative flip back to rise—only to lose the tentative low and flip back to negative (see “U.S. Economic Leading Indicators” chart). Indeed, this has occurred. However, we are beginning to see some ‘green’ lights on our dashboard that are promising in terms of staying positive.”

“We have been looking for early signs of the recession reversing direction and the eventual general economic recovery ever since nearly all the leading indicators on our dashboard flipped from green (rise ahead) to red (decline ahead),” Beaulieu explained. “We have stated in prior months that it would be normal to see some indicators that reverted to negative flip back to rise—only to lose the tentative low and flip back to negative (see “U.S. Economic Leading Indicators” chart). Indeed, this has occurred. However, we are beginning to see some ‘green’ lights on our dashboard that are promising in terms of staying positive.”

These are occurring in two categories: financial and marketing, according to ITR Economics. “The financial is admittedly more cause for trepidation in some people’s minds, because the market is not always seemingly rational,” Beaulieu explained. “The improvement in the manufacturing-based leading indicators is easier to understand and accept, since it is logical that industrial activity would come back online as states open their economies back up. Our analysis indicates the positive leading indicator trends currently evident have a reasonable probability of being sustained. We expect more indicators to flip to green, assuming a second wave of COVID-19 and/or governmental action doesn’t shut us down again.”

Other sectors reflect positive momentum

After a horrendous decline in March and April, department stores and total trends are now heading in a positive direction. “This is important for understanding that the economy is staging a comeback,” Beaulieu said. “The timeline fits our forecasts for the onset of a general, albeit uneven, recovery.”

Another indicator ITR Economics is closely monitoring is weekly mortgage applications for purchases (as opposed to refinancing). Mortgage applications for purchases activity is improving as of a March 30, 2020 low, the report shows.

“The retail sales input and the mortgage applications input suggest that two critical components to our economy—retail and housing—are mending,” Beaulieu said.

While data points for restaurant bookings and airline travel are still very depressed, the trends are now heading in the right direction, ITR research shows.

Then there is non-scientific data such as Apple Maps trends, which is showing an upward trend in requests for both driving and walking directions as travel restrictions are gradually being lifted.

“These observations support what we have been saying over the past several tumultuous months: ‘This, too, shall pass,’” Beaulieu said.

Discussion on potential additional aid for small businesses

Earlier this month, Treasury Secretary Steven Mnuchin addressed lawmakers on the subject on a potential “next round” of economic stimulus legislation to help industries that have been hit hardest by the coronavirus pandemic.

Testifying before the Senate’s small-business committee, Mnuchin said he believed the economy would improve sharply in the second half of the year but added there was still significant damage to parts of the economy that needed to be addressed.

The White House has held off on negotiating with Congress over another economic relief package so they can more thoroughly assess how the existing measures are working. Just last week, the Federal Reserve announced an expansion of Main Street Lending Program to help businesses weather the storm.

“There’s no question that small businesses in many industries are going to need more help,” Mnuchin said.