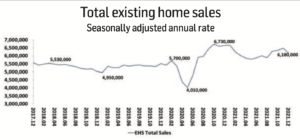

In 2021, the builder market held up well against the headwinds facing the U.S. economy. But construction material and labor shortages, housing affordability and backlogs threaten to derail the segment’s progress this year. Throw in skyrocketing inflation and interest rates, and you have a perfect storm that could rain on the housing market’s parade in the second half of 2022.

“A growing shortage of affordable housing and rising housing costs stemming from historically high price levels for lumber and other building materials, supply chain bottlenecks, surging interest rates and excessive regulations are hurting families and communities nationwide,” Jerry Konter, National Association of Home Builders (NAHB) chairman and a homebuilder and developer from Savannah, Ga., stated in a recent release. “Building professionals from across the nation are sending a loud and clear message that Congress must act now to help improve affordability conditions by implementing policies that will help builders to construct more single-family homes and apartments to meet consumer demand.”

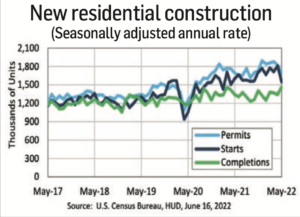

The latest new residential construction data paints a cloudy picture for short-term growth prospects. Building material prices are up 47% since the beginning of the pandemic in early 2020, NAHB reported. In May, privately owned housing starts dipped 14.4% below the revised April estimate to a seasonally adjusted rate of 1.55 million, a 3.5% drop from the May 2021 rate of 1.62 million, according to the U.S. Census Bureau.

Single-family housing starts declined 5% to a seasonally adjusted rate of 1.05 million, the third consecutive month of decline, according to the Census Bureau. The seasonally adjusted rate was down a similar percentage from year-ago levels. It’s the latest indicator the housing market is softening due to rising mortgage interest rates and ongoing supply chain bottlenecks that delay construction projects.

“Given these market challenges, we are anticipating single-family construction will remain flat this year and decline in 2023 as higher interest rates weigh on housing affordability,” said Fan-Yu Kuo, an NAHB economist.

Construction results are mixed when viewed on a regional basis. The biggest decreases in housing starts are in the South and West (18% and 21%, respectively), the Census Bureau reports, although the South is where most homebuilding takes place based on a seasonally adjusted rate of 803,000 units. The Northeast posted the biggest spike, growing 13% to 173,000 units followed by the Midwest (2%) at 217,000. This data, however, should be taken with a grain of salt as it can be skewed by peaks and valleys in key regions, observers say.

Developers of single-family housing are walking a tightrope in attempting to balance compet- ing forces. “On the one hand, strong positive demographic forces and underlying economic fundamentals support gains in new construction,” noted Sarah Martin, senior economist, Dodge Construction Network. “On the other, sharply negative pressures have developed from tight supply, inflated materials prices—stemming from the pandemic’s supply chain disruptions—and now rising mortgage rates that may thwart expansion.”

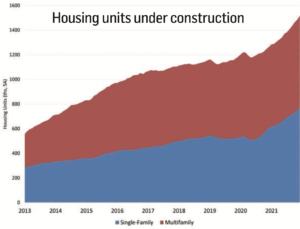

In contrast, the seasonally adjusted rate for multi-family starts plummeted 27% to 469,000 in May, offsetting strong gains from the prior month when demand for apartments increased, according to the Census Bureau. Still, this figure lags only 3% behind the May 2021 growth rate of 485,000.

“We expect both multi-family construction and remodeling will continue to expand this year, although high construction costs and affordability challenges are making some developers increasingly cautious,” said Robert Dietz, NAHB’s senior vice president and chief economist.

Dodge is equally bullish for market growth, predicting multi-family starts to rise 4% in 2022 to 707,000 units. At least two demographic trends will underpin lively levels of multi-family housing starts moving forward. “First, a significant number of households are expected to move to less dense locations outside of central cities, Dodge’s Martin said. “Second, increasing numbers of millennials and others are expected to either remain renters or become homeowners by choosing condos as attractive alternatives to higher-priced single-family homes.”

Indeed, a deep dive into the housing data indicates it is premature to ring the alarm bell. While privately owned housing units authorized by building permits in May fell 7% below the revised April rate of 1.82 million, this pace is nearly equal to the May 2021 rate, the Census Bureau reported. The lion’s share of building permits comes from single-family authorizations, which decreased 5.5% from the prior month to a rate of 1.05 million. Authorizations of units in buildings with five units or more declined 10% from April to a seasonally adjusted rate of 592,000, but that figure is up nearly 17% from a year ago.

What’s more, the 283,000 privately owned housing units authorized but not yet started was up 12% from a year ago and slightly over April 2022, the Census Bureau reported. This is a stark reminder that builders require a steady flow of lumber and other building materials to keep projects moving along.

Macro issues

To fight inflation, the Federal Reserve continues to tighten monetary policy and raise interest rates. Fannie Mae estimates the monthly principal and interest payment to purchase a median-priced home has risen $500 since the beginning of the year due to the rapid rise in mortgage rates. “This will undoubtedly slow the economy, and we expect a modest economic recession in mid-2023 given tightening financial conditions and increased economic uncertainty,” NAHB’s Dietz noted.

To fight inflation, the Federal Reserve continues to tighten monetary policy and raise interest rates. Fannie Mae estimates the monthly principal and interest payment to purchase a median-priced home has risen $500 since the beginning of the year due to the rapid rise in mortgage rates. “This will undoubtedly slow the economy, and we expect a modest economic recession in mid-2023 given tightening financial conditions and increased economic uncertainty,” NAHB’s Dietz noted.

All are major concerns for new home developers as builder confidence in May dropped for the fifth straight month and recorded the lowest reading since June 2020, NAHB reported. Supply-chain disruptions and increasing lending rates threaten to exacerbate affordability problems in the months ahead. “Higher home costs are pricing buyers out of the market, especially entry-level and first-time buyers,” NAHB’s Kuo explained. “The best way to ease growing affordability challenges is for policymakers to address ongoing supply chain disruptions to help builders bring down construction costs and increase production to meet market demand.”

These and other issues have a trickle-down effect on builder dealers servicing new home buyers. “Flooring is still (about) service and freight,” noted Doug Davis, president, Artisan Design Group in Dallas. “Supply chain has been difficult with material delays, shipping delays, etc.”

While some housing demand is expected to be sidelined with higher mortgage rates and the threat of a recession, the housing deficit is expected to persist. “Demand will come back when interest rates eventually move back down following an economic downturn,” Kuo said. NAHB estimated a net deficit of U.S. housing totaling more than 1 million homes.

When the dust settles, labor issues are projected to emerge as the top limiting factor for home construction. The construction worker shortage has been well documented the past 10 years—and 2022 is no different. There is a record-high shortage of 449,000 workers in the construction industry, NAHB reported.

“The skilled labor shortage is resulting in construction delays and higher homebuilding costs and will affect the interplay between builders, subcontractors and suppliers,” Kuo said. “This shortage will also persist through an economic downturn.” Some regions face a shallower pool of craftsmen than others, which can directly impact speed to market.

Home buyer trends

Further compounding matters is consumer confidence in the housing market. The Fannie Mae Home Purchase Sentiment Index remained relatively flat in May but inched closer to its 10-year and pandemic-low of 63 from April 2020. Surveyed consumers continue to express concerns about housing affordability with the “Good Time to Buy” indicator reaching a new survey low, as 79% of respondents reported that it’s a bad time to buy a home.

Further compounding matters is consumer confidence in the housing market. The Fannie Mae Home Purchase Sentiment Index remained relatively flat in May but inched closer to its 10-year and pandemic-low of 63 from April 2020. Surveyed consumers continue to express concerns about housing affordability with the “Good Time to Buy” indicator reaching a new survey low, as 79% of respondents reported that it’s a bad time to buy a home.

“These results suggest to us that increased mortgage rates, high home prices and inflation will likely continue to squeeze would-be home buyers, as well as those potential sellers with lower, locked-in mortgage rates—out of the market, supporting our forecast that home sales will slow meaningfully through the rest of this year and into next,” Doug Duncan, Fannie Mae senior vice president and chief economist, stated in a release.

In addition to timing, there are underlying factors affecting housing and flooring selections for all age groups. For example, millennials and the oldest members of Generation Z have suffered the largest share of job losses since the pandemic and are also the most likely cohort to be renters, Dodge’s Martin said, noting payroll employment remains 1.2 million jobs below pre-pandemic levels as of April. “Furthermore, as multi-family construction shifts to smaller, suburban projects outside of central cities, the share of large, luxury high-rise construction projects could decline and subdue overall construction starts going forward.”

The pandemic has sparked a need for more living space and people continue using their homes for more purposes, particularly teleworking. According to fourth quarter 2021 data from the Census Quarterly Starts and Completions by Purpose and Design and NAHB analysis, the median single-family square floor area rose to 2,338 square feet while average (mean) square footage for new single-family homes increased to 2,561. “We expect home size to continue to increase modestly, given a shift in consumer preferences for more space due to the increased use and roles of homes—for work among other purposes—in the post-COVID-19 environment,” NAHB’s Dietz said.

Flooring choices are impacted, in part, by how these spaces are utilized. “Product performance in the new open floor plans and the way product performs in high-traffic areas [tends to favor] hard surfaces because of their durability,” ADG’s Davis said. “I feel like it plays against the builder when they have to cut to meet affordability and miss out on customer satisfaction.”

Forward view

Looking ahead, high inflation is expected to constrain consumer budgets along with rising rents, higher home prices and increases in mortgage rates. At the same time, wages continue to remain well below the pace of inflation. “With more limited purchasing power, buyers, renters and investors that had become a large piece of demand when interest rates dropped are expected to pull back,” Martin said. “And housing construction will decelerate from the record highs seen over the last two years. On the supply side, rising material costs, labor shortages and supply chain issues will also contribute to the deceleration in new residential construction.”

In the long term, Dodge said strong demographic trends and economic fundamentals will keep demand positive.

As Martin explained: “We still expect growth in both the single-family and multi-family sectors in 2022—just at a more subdued pace.”