By Steven Feldman Another year, another statistical issue in the can. We are publishing this report about six weeks earlier than our typical end-of-June time frame because we didn’t want this labor-intensive issue hanging over our heads as we headed into Surfaces.

By Steven Feldman Another year, another statistical issue in the can. We are publishing this report about six weeks earlier than our typical end-of-June time frame because we didn’t want this labor-intensive issue hanging over our heads as we headed into Surfaces.

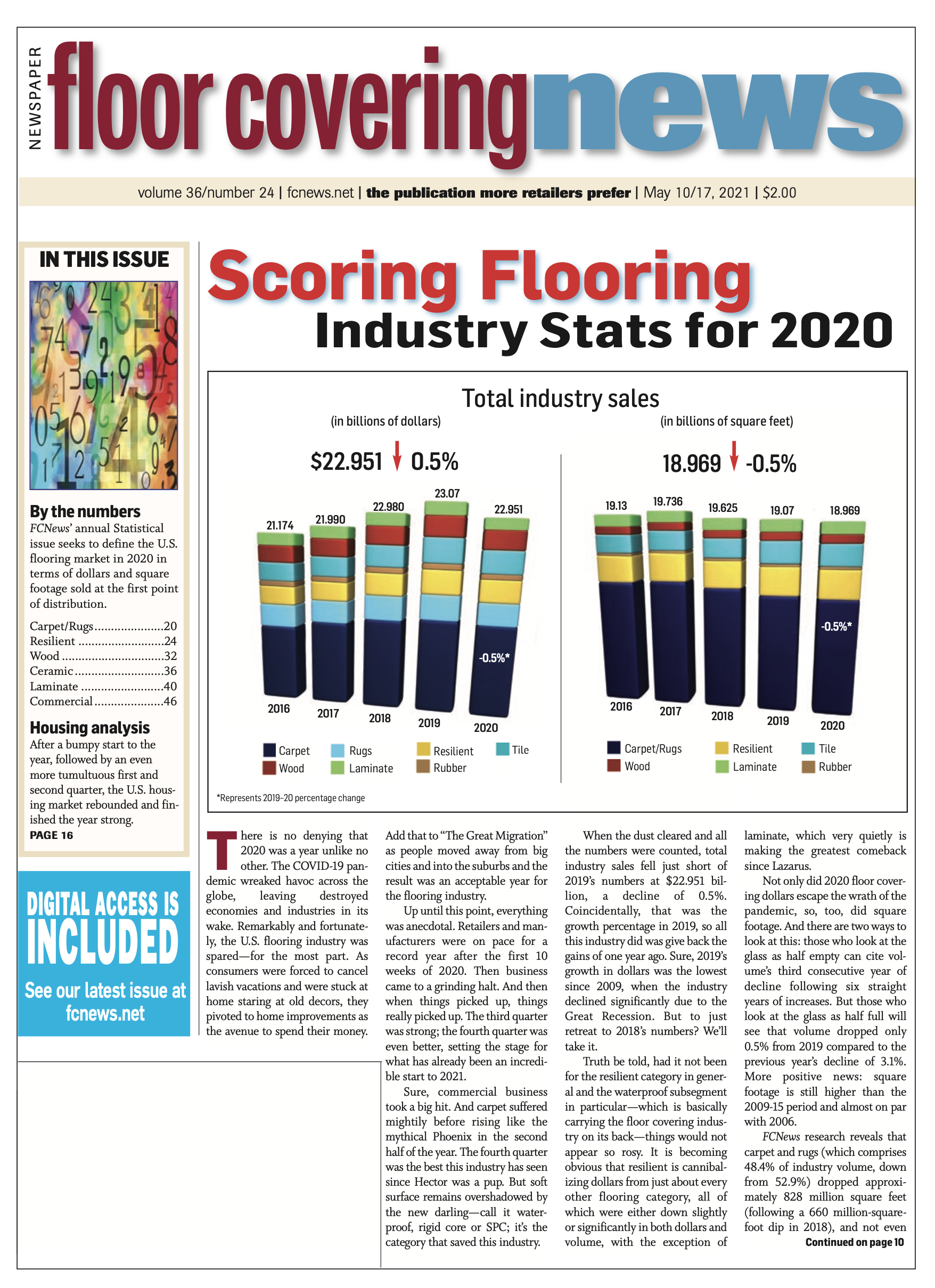

The big difference from years past was that when we embarked on this project a few months ago, we really had no idea how the numbers would turn out after the pandemic basically battered the second quarter. The cancellation of live events this winter and spring prevented the anecdotal chats that typically serve as a starting point of defining the previous year from a numbers perspective. But when the dust cleared, FCNews research has determined that the industry fared much better than most would have thought, down less than a percentage point in both dollars and volume. The biggest drag? Commercial carpet, down more than 21%. Luckily, that was offset by the burgeoning LVP/SPC category.

Other statistical reports will be released, and I’m sure those numbers will be different. Some include stone and wall tile; others are simply incredulous. But we are extremely confident that at the end of the day, FCNews has framed the industry in 2020 as accurately as possible. Every time we doubted a number we reached out even further within the industry. And each time our research was validated.

Four out of the five major categories were relatively straightforward. For carpet, we began with CRI numbers and then conferred with top-level industry executives from the largest mills. For hardwood, we started by polling industry-leading manufacturers, then took government numbers and extrapolated things like plywood, truck bedding and engineered floors that are misclassified as wood. (We know that other reports do Now for resilient, which has become the most complicated category to get a handle on… My 25-plus years in this industry has earned a significant amount of trust—what is confidential stays confidential. So, 15 of the leading resilient suppliers shared their exact numbers with me from residential sheet to commercial sheet to VCT to linoleum to the dreaded LVT category and all its components, notably glue down, click, WPC, SPC, both for residential and commercial. That was the easy part. But then there is that “other” category. Determining its size can be the biggest challenge because just about all of that is imported LVT and SPC. Whatever numbers we came up with here would pretty much determine the accuracy of this entire report.

Here’s the thing: It’s bigger than anyone realizes or wants to acknowledge. Between Home Depot (Halstead) and Floor & Décor (CFL), you have close to $700 million in purchases. (All you need to do is see how much resilient these behemoths sell, then back out their margin to see how much they are purchasing.) You have the direct importers, whether they be large retailers or distributors. You have a few domestic OEM providers like Nox and Lico. And then you have all the commercial companies that can be doing anywhere from $5 million to $40 million.

We could not have believed that resilient was up more than 20% last year. And that’s with residential sheet and commercial sheet down 10%. That’s when I started working the phones. Much to my surprise, few were surprised at our research. I did not believe commercial LVT would be in the black. Steve DeCarlo from Milliken thought it was up 3%. We had it up 5%. I asked Raj Shah about 20%-plus overall LVT growth, and he told me he had the same numbers. Floor & Décor was up 25% in vinyl, and that number at retail is around $420 million. Flooring represents $8.16 billion at Home Depot and was up 9.6% in 2020. You know resilient was up even more than that. So, it makes sense.

The only statistic that’s a bit fuzzy in resilient is the mix between residential and commercial, and it’s because of multifamily. Some companies consider this chunk part of their commercial business, some residential, some both. The challenge is that it’s a residential product that is often specked commercially. I realized this when one knowledgeable observer told me commercial LVT was $1.8 billion in 2020. We have it at $1.3 billion. And then he told me he had multifamily around $500 million. So, there you go. not take such a comprehensive approach.) For ceramic tile, we looked at Tile Council of North America numbers, statistics from the leading importers like Italy and Spain, and then reached out to the largest ceramic suppliers for their input. For laminate, we consulted respected and trusted organizations such as the North American Laminate Flooring Association (NALFA), which oversees domestic supply, and supplemented that data with research provided by the European Producers of Laminate Flooring (EPLF), which covers imported laminate flooring. We further adjusted the raw data provided by those associations to weed out any duplication from OEM providers.