Another stats issue in the can. Maybe we here at Floor Covering News can reclaim our lives just in time for summer. The task of getting the numbers right—or as right as humanly possible—is the most time-consuming exercise the staff undertakes all year. Research involves getting our hands on as many reports as possible and talking to as many people as possible, both from companies and associations.

Another stats issue in the can. Maybe we here at Floor Covering News can reclaim our lives just in time for summer. The task of getting the numbers right—or as right as humanly possible—is the most time-consuming exercise the staff undertakes all year. Research involves getting our hands on as many reports as possible and talking to as many people as possible, both from companies and associations.

Reggie, Ken and Megan do an amazing job at running the wood, laminate, carpet and ceramic stats numbers through the wash multiple times. Needless to say, they are squeaky clean. Somewhere along the way I took on the task of compiling the resilient numbers. I took on resilient because there are so many components to the category. Residential and commercial sheet. Residential and commercial LVT. Linoleum. VCT. Resilient tile. And within every category there are sub-categories. Felt/fiberglass. Homogeneous/heterogeneous. Glue-down/flex click/loose lay/SPC/WPC/ MGO. It goes on and on.

So a few years ago, I came up with a cockamamie idea: I’ll just call a few of the major players for stats and get their sales figures. Why would they agree to share confidential information? Two reasons: 1. If they help me get the most accurate numbers, they have the best numbers to benchmark against. 2. They know I’m going to keep the numbers confidential. After doing this for 30 years, I’ve built a little cred. Plus, I don’t talk to anyone outside the industry anyway. I guess I’m the new Howard Hughes.

When all was said and done, I spoke to about 25 companies that were doing between $50 million and multiple billions in the category—executives who were kind enough to break down their numbers to the dollar and square footage in all the various sub-categories. I estimated the “others” through many calls with industry sources. My 24-year-old son then taught me how to add columns in Excel. =SUM(A2:A27). Pretty cool, right? When the dust settled, my laptop was more valuable than Hunter Biden’s; the difference is I don’t leave mine behind. Bottom line: These numbers are as accurate as you’re going to get.

By the way, I do want to thank everyone who responded so quickly and made my life only half as hellish as it would have been otherwise. I even appreciate those few companies that I had to hound 15 times. (Wow – they’re either getting it from Dustin or me!) Full disclosure: I was unable to get CFL’s numbers, but let’s just say there is more than one way to skin a cat. As for everyone else, I owe you a drink.

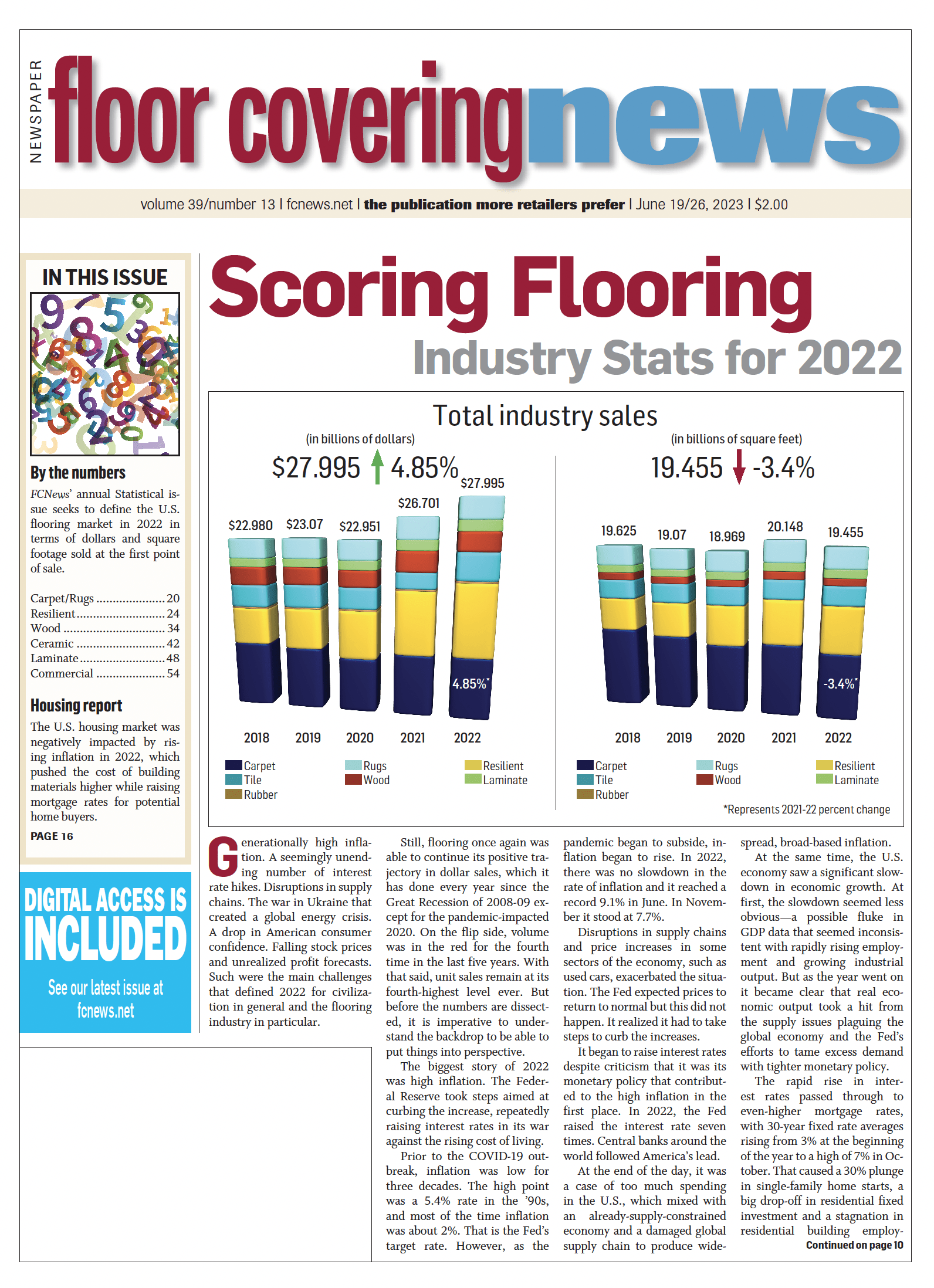

So what stands out as you peruse this issue of Floor Covering News? It’s not really surprising to see dollars up nearly 5% and volume down about 3.5%. It’s called inflation, people. The flooring industry in 2022 was paying the price for the nearly $2 trillion in COVID-19-related handouts.

What else? Wood suffered its biggest declines in years. Why? Many consumers opted for more budget-friendly options like rigid core or laminate when renovating their homes. Speaking of laminate, the category grew about 6% in dollars and 4.5% in volume, capitalizing on ample domestic availability and much-improved features and benefits. Plus, there have been issues with the lower-priced rigid core products, which drove some consumers to laminate. Ceramic tile felt the inflation bug more than any other category, increasing 14% in dollars but dropping a percentage point in volume. Can you say, “price increases” and “freight costs for a heavy product?” Carpet was up slightly, driven by the commercial market because residential was down nearly 6% in dollars and 11% in volume.

Lastly, resilient is driven by LVT, and so much of that is imported. Freight costs did not abate until toward the end of the year, which is also when prices started to decline after a series of increases. Thus, it’s not surprising that LVT, and SPC in particular, still grew in the mid double-digits, like 14%, but when it came to volume, the number was short of 7%, its first non-10%-plus growth year in quite some time.

Final thought: There are other reports out there. The numbers will be different. We don’t include stone flooring. We don’t include ceramic wall tile. We don’t include rubber cove base and treads. And for Pete’s sake—the wood number is NOT $3.5 billion. Stop using government numbers that include things like flooring for tractor trailer flatbeds and imports that are misclassified as real wood. Do your homework!

Enjoy the issue.