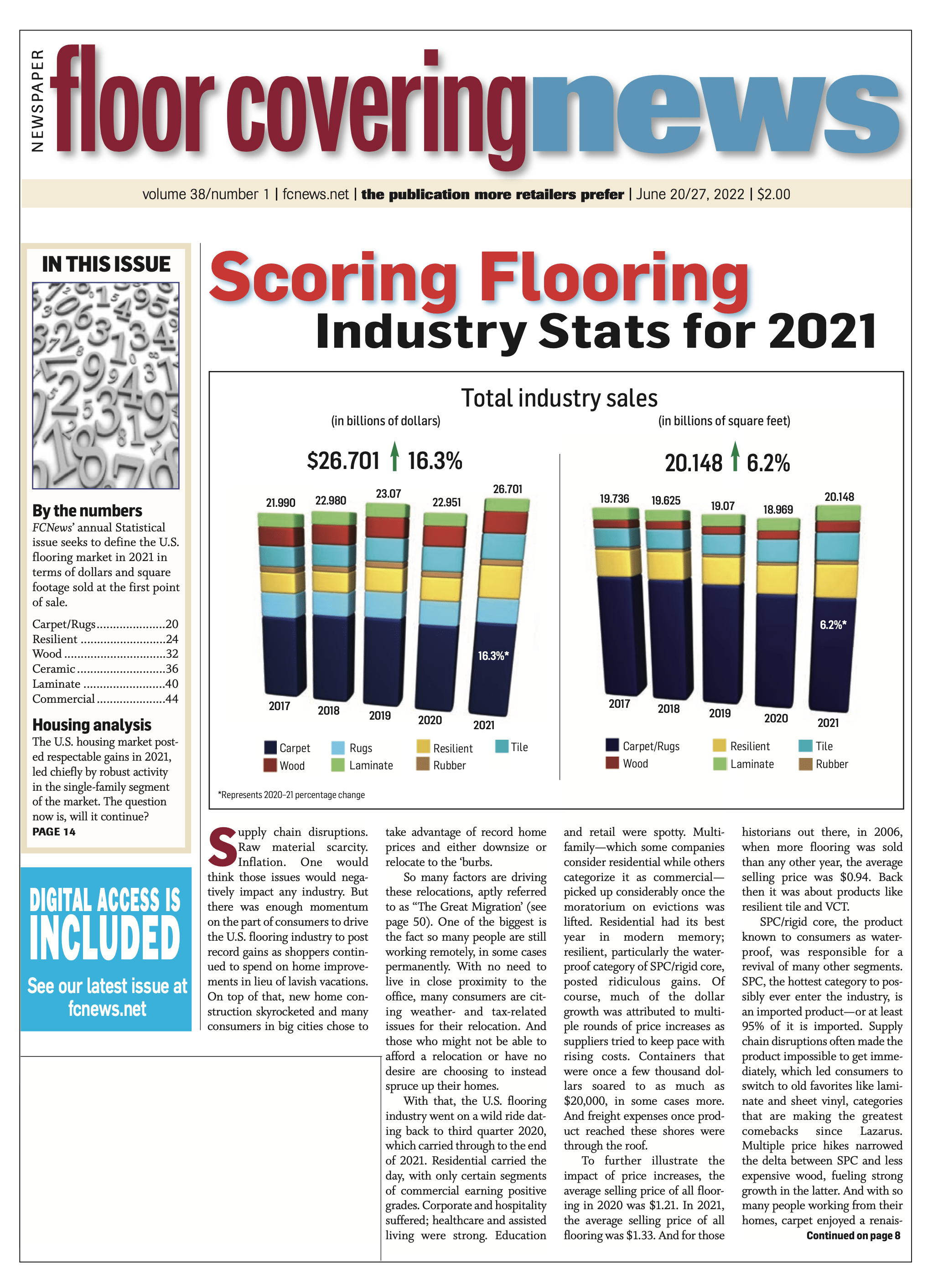

After experiencing declines in both sales and square footage in 2019 and 2020, the U.S. hardwood flooring market orchestrated a dramatic turnaround in 2021. FCNews research shows wood flooring sales at the first point of sale in 2021 totaled a record $2.67 billion, a head-turning increase of 21% over 2020. The volume growth of the hardwood flooring market in 2021 was equally impressive. Square footage climbed 16% to 1.03 billion square feet—that’s the first time the category surpassed the billion-square-foot mark in 15 years.

More impressive numbers: Since beginning its climb out of the Great Recession in 2011, the hardwood category is up 70% in dollars and 58% in volume.

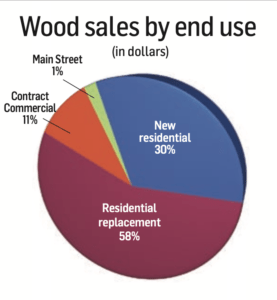

The higher sales-growth-to-volume-ratio shows suppliers were still able to generate healthy increases in an era when so many materials and imported alternatives are in short supply. More importantly, the discrepancy in the rate of dollar growth to unit increases reflects higher prices incurred on the supply side—not simply pure organic growth.

The higher sales-growth-to-volume-ratio shows suppliers were still able to generate healthy increases in an era when so many materials and imported alternatives are in short supply. More importantly, the discrepancy in the rate of dollar growth to unit increases reflects higher prices incurred on the supply side—not simply pure organic growth.

“We estimate that probably 10% of the 21% growth in sales that hardwood achieved last year was probably due to price hikes and inflation,” said Brian Carson, president and CEO of AHF Products. “American-made products were significantly impacted by lumber inflation, and then you have overseas products getting significantly hit by freight inflation. Both are going up, but they’re going up for different reasons.”

The gains that the hardwood flooring market made in 2021 were legitimate nonetheless. Industry executives cite the impact of the robust demand for flooring—and hardwood in particular—on remodeling spending in the U.S. last year.

“We firmly believe the hardwood category grew in the range of 20% in 2021,” said Pat Oakley, vice president, Mullican Flooring. “With home values increasing to record levels, homeowners are willing to invest more dollars and upgrading their preferences when completing home remodeling projects. That’s great news for the hardwood category.”

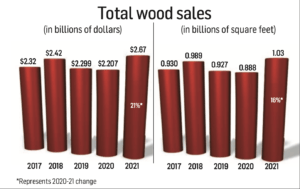

Hardwood’s performance in 2021 helped the category increase its share of total floor covering sales, albeit slightly, to 10%. However, with respect to hard surface revenues, hardwood grew its share to nearly 17%—up slightly from 15% in 2020.

Hardwood’s performance in 2021 helped the category increase its share of total floor covering sales, albeit slightly, to 10%. However, with respect to hard surface revenues, hardwood grew its share to nearly 17%—up slightly from 15% in 2020.

The fact that hardwood flooring was not only able to keep pace but also incrementally improve its share of total flooring sales is a testament to the fact it remains arguably the most aspirational flooring product, observers say. This despite the immense popularity of the resilient category, specifically LVP/SPC/WPC products. In 2011, for example, hardwood represented 9.1% of industry sales—that was the same percentage of sales the category saw in 2006. In the 15 years since, those resilient subsegments have gone on a tear, but wood’s share has never fallen below 9.2% during that period.

“The consumer had discretionary income and was willing to spend it on hardwood flooring last year,” said Jamann Stepp, vice president, hard surfaces for Fabrica Hardwood, a division of The Dixie Group. Even more remarkable, he noted, was how the category mustered gains even though suppliers experienced tremendous supply chain challenges, ocean freight issues and raw materials increases.

Other major suppliers attested to the strides hardwood made in 2021 despite a challenging environment. “2021 was a great year for the hardwood sector,” said Brad Williams, vice president of sales and marketing, Mirage, whose internal research puts volume growth in the 18%-20% range. In terms of dollars, he estimated the category could have possibly grown 25%-35% due to the impact of inflation and the fact that suppliers, including Mirage, had raised the prices at a “higher-than-normal rate,” he noted.

Minus the impact of inflation/price hikes on hardwood flooring in 2021—which conservatively accounts for roughly 10% of the 21% increase in sales, suppliers concede—it has been a few years since the category has seen organic increases anywhere near that mark. The closest in recent history—and it really wasn’t that close—was 2018, when U.S. hardwood sales hit $2.42 billion, a 4.3% increase over the year prior. During that same stretch, volume grew 6.3% to 989 million square feet. The dynamics in the industry that year, ironically, were just the opposite of what occurred in 2021. Four years ago, it was actually volume that outpaced dollar growth, reflecting an influx of much less expensive products into the market.

Minus the impact of inflation/price hikes on hardwood flooring in 2021—which conservatively accounts for roughly 10% of the 21% increase in sales, suppliers concede—it has been a few years since the category has seen organic increases anywhere near that mark. The closest in recent history—and it really wasn’t that close—was 2018, when U.S. hardwood sales hit $2.42 billion, a 4.3% increase over the year prior. During that same stretch, volume grew 6.3% to 989 million square feet. The dynamics in the industry that year, ironically, were just the opposite of what occurred in 2021. Four years ago, it was actually volume that outpaced dollar growth, reflecting an influx of much less expensive products into the market.

The meteoric rise in hardwood pricing in 2021 recalls a period in 2013, where the wholesale price of hardwood rose 4.6% to approximately $2.50 per square foot (last year it was $2.59 per square foot wholesale). During that period, industry observers recall, the industry was dealing with volatile raw materials pricing due to shortages of red oak and maple lumber.

Channel sales activity

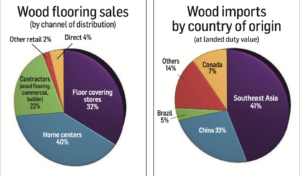

In much the same way that home centers have seized more of the market share in laminate retail sales, the nation’s big boxes also continue to nip share with respect to hardwood flooring sales. FCNews research shows home centers represented about 40% of wood flooring sales in 2021, up from roughly 38% in 2020. Specialty retail stores, by comparison, made up about 32%. Looking back five years ago, home centers accounted for less than 35% of hardwood sales with specialty retail representing about 39%.

In much the same way that home centers have seized more of the market share in laminate retail sales, the nation’s big boxes also continue to nip share with respect to hardwood flooring sales. FCNews research shows home centers represented about 40% of wood flooring sales in 2021, up from roughly 38% in 2020. Specialty retail stores, by comparison, made up about 32%. Looking back five years ago, home centers accounted for less than 35% of hardwood sales with specialty retail representing about 39%.

Traditional home centers are not the only threat. Floor & Décor, which has been rising in prominence over the past few years, is also beginning to siphon off sales from the specialty retail channel. Company financials show the retailer generated roughly $275 million in hardwood flooring sales. That puts hardwood at 8% of its sales in 2021—up from 6% the year prior. Projections indicate the retailer is poised to continue grabbing share as indicated by a compound annual growth rate of 25.5% percent from 2017-2021 including all categories.

Even discount stores and outlets specializing in closeout products are cashing in on wood’s enduring popularity. LL Flooring (formerly Lumber Liquidators) generated roughly $291.5 million sales in hardwood products last year. That puts its hardwood flooring product sales at roughly 25% of total revenues. LVP, laminate, bamboo, porcelain tile and cork, as well as installation materials and services, account for the remainder.

The good news in all this is specialty retailers—along with the traditional wood flooring contractor channel—appear to be holding on to a respectable share as homeowners become more dependent on experienced installation services in an era in which the universe of trained installers is dwindling.

Engineered grows share

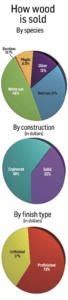

As hardwood revenues climb, so goes the share of engineered versus its solid counterpart. FCNews research shows multi-layered hardwood flooring increased its share from 65% of total wood sales in 2020 to approximately 68% in 2021. That reflects the ongoing shift within the category that began to accelerate over the past 10 years. Five years ago, for instance, engineered products’ share of the total hardwood flooring market was about 58%-60%. Going back even further to 2011, engineered share was about 52% of total category sales, estimates show.

Industry observers attribute the ongoing market-share shift to improved raw material yields as well as innovations in core constructions that enhance the already durable characteristics of hardwood flooring. “Engineered hardwood has consistently been at approximately 65% of the total hardwood flooring market,” said John Hammel, senior director of hardwood and laminate, Mannington. However, solid typically commands higher profit margins. “The price increases we saw in 2021 could have increased solid’s dollar share.”

Some industry executives estimate the ratio of engineered vs. solid was even higher than the widely accepted 65/35 percent split. “Solids continue to slowly lose market share as capacity comes offline domestically and imports, which are predominantly engineered products, are growing,” Mirage’s Williams said. “I would estimate that engineered products represent 70% of the overall market in hardwood.”

Mercier, another prominent Canadian manufacturer, attested to the shift. “In the past, we were 60/40 solid vs. engineered, but now we’re moving closer to what the industry is today as a whole,” said Wade Bondrowski, director of U.S. sales. “Our engineered business has grown about 7%, which we attribute to higher sales of wider/longer plank products. So we’re seeing sales increases not only through price increases but better-end goods.”

Not all suppliers are ready to throw in the towel on solid wood floors just yet. Mullican’s Oakley remains a solid proponent. “There is still strong demand across both solid and engineered hardwood segments,” he said. “In fact, solid flooring price increases were higher as a percentage of the overall wood market, so this would reflect a shift in total dollars toward solid.”

Truth be told, solid—although it is declining in share—still has its place in the market. “I think solid held its own last year,” AHF’s Carson said, citing regions of the country, i.e, the Northeast and Midwest, where engineered has not gained a foothold. “That’s a solid hardwood ‘power alley.’”

Others attest to solid’s strength. “We actually saw a resurgence in solid hardwood last year,” said Dan Natkin, CEO and managing director of Boen Hardwood Flooring.

Impact of wood/rigid hybrids

Engineered hardwood flooring, in the traditional sense, covers all formats that include a real wood veneer bonded to a wood or wood by-product-based core (i.e., HDF) and then balanced by a wood backing comprising spruce, eucalyptus or another species not typically used on the face of the product. But what about the influx of wood/rigid core hybrids that have hit the market in the past four to five years? Where do they fit?

Engineered hardwood flooring, in the traditional sense, covers all formats that include a real wood veneer bonded to a wood or wood by-product-based core (i.e., HDF) and then balanced by a wood backing comprising spruce, eucalyptus or another species not typically used on the face of the product. But what about the influx of wood/rigid core hybrids that have hit the market in the past four to five years? Where do they fit?

Officially, the National Wood Flooring Association has deemed such products as real “engineered” wood floors, given the genuine wood face regardless of the core material used. Estimates vary widely, but the general consensus is wood/rigid hybrids now account for anywhere from 3% to 6% of the engineered portion of the hardwood flooring market.

“I would say that’s directionally accurate,” David Moore, senior product director, wood and laminate, Mohawk, noted. (Incidentally, Mohawk over the past few years has converted its entire hardwood flooring offering to a real wood veneer over an HDF platform.) “Wood/SPC products is probably closer to 3% of the engineered wood market.”

Boen’s Natkin puts wood/SPC hybrid’s share in the low single digits. “We estimate the subcategory represents about 2%-3% of the wood market,” he said.

Others, like Mannington’s Hammel, estimate hybrids may have increased their share of the market to roughly 4% of category sales. Ditto for Mirage’s Williams, who put hybrids share in the same ball- park at “less than 5% of the engineered wood market.”

So where, precisely, does that put wood veneer/SPC core hybrid sales in terms of square footage and revenues? Hard numbers are even harder to come by, but some executives took a stab at it. “We put the hybrid market somewhere in the vicinity of 20 million square feet in the U.S.,” one executive told FCNews. If you further extrapolate that hybrids anecdotally represent anywhere from 2% to 4% of engineered sales, that puts the sub-category somewhere between $30 million and $40 million, according to FCNews estimates.

Imports vs. domestic

Beyond new formats and constructions, seismic shifts are also occurring with respect to the locations where both finished hardwood flooring materials and components (i.e., cores) are sourced. For instance, China, which accounted for roughly 40% of hardwood flooring imports in 2020, saw its share drop to about 33% in 2021. It’s worth noting that China’s share of the U.S. hardwood market was 46% in 2019, providing evidence that the downward trend in hardwood shipments from that country persists.

The cause of China’s sliding market share, observers say, is rooted in geopolitical issues. Many of the tariffs and import duties put in place during the Trump administration have largely remained in place, while antidumping measures and fines have restricted shipments from the region. The primary intention of these actions was to encourage greater domestic production of hardwood, but the beneficiaries of this import market share shift, ironically, were producers in Southeast Asia. This region saw its share rise dramatically from about 28% in 2020 to roughly 41% last year. Hardwood flooring imports from Asian countries not subject to tariffs and/or antidumping duties(i.e., Taiwan, Thailand Indonesia) surged, as did shipments from large manufacturers based in South America.

These shifts—as well as higher demand from competing building trades and industries amid strained raw materials and higher costs overall—resulted in higher hardwood prices. Couple that with extenuating factors such as blockages and tie-ups at major shipping ports around the country—which have alleviated in recent months but still present challenges—and you have the recipe for escalating prices. Over the course of the past year, many of the major hardwood suppliers have announced multiple price hikes on both sourced and locally produced flooring. The increases have happened at such a frequency, observers say, that it has become the norm.

No sooner than distributors and retailers adjust their pricing, additional hikes follow soon thereafter. While some manufacturers strive to absorb some of the costs in order to help their partners throughout the chain remain more competitive, executives say it’s an issue that’s having wide-ranging impacts. “There appears to be a more focused interest among distributors and large retailers to diversify their supply chain, especially with the ongoing tensions between the U.S. and the Chinese government,” said Jodi Doyle, vice president of sales and marketing, Indusparquet. “South America, namely Brazil, has become a great option for these buyers, because they can get high-quality product efficiently and at a competitive price.”

Indusparquet, as it turns out, is reaping the rewards of that shift. “We enjoyed a tremendous turnaround year in 2021, both regarding top line sales revenue and total square feet sold,” Doyle added. “Our top-line sales in 2021 were up 19.5% versus the same period in 2020 and also slightly ahead of the 2019 sales total. Total square footage was up 21% in 2021 over 2020, but did lag behind the 2019 figures. We definitely experienced tremendous growth in 2021 and we would attribute that to the pent-up consumer demand created by the COVID-19 pandemic, as well as a focus on home space renovations.”

Other industry observers also see other countries stepping up to fill the void. “Southeast Asia continues to surge while China moderates,” Boen’s Natkin said. “Europe has seen some strong gains as well.” Fabrica Hardwood’s Stepp concurred. “If we saw any significant shift, I think the 40% share once attributed to China has gravitated toward Malaysia, Thailand, Indonesia and Vietnam,” he explained. “Those countries have definitely increased a few percentage points. While China still holds the lion’s share of those exported products, there’s only so many companies you can source from in China where you don’t pay anti- dumping/countervailing duties, tariffs. It’s still a huge supplier.”

Not to be undone, U.S. producers also benefitted from the market’s pivot back to domestic sources. “Our U.S.-made products are doing very well,” said Kyle McAllister, director, of hardwood and laminate category, Shaw. “We continue to leverage our internal assets, and we try to drive that. More importantly, COVID-19 has taught us that having the material is important. We do import some goods; however, we have factories here in the U.S., and we’re going to continue looking at cost optimization and research and development as well.”